Insights

The latest VALID news and insights.

Key Fraud Fintech Trends of 2024 | Industry Insights and Prediction by Valid Systems

In 2024, the fintech landscape witnessed a surge of opportunities propelled by advancements in artificial intelligence (AI) and computational excellence. As a trusted partner to numerous leading financial institutions and pioneering fintech entities, Valid Systems stands uniquely positioned to provide insights into pivotal trends, notably within the realms of fraud mitigation and risk assessment

Overdraft Innovation: Small Dollar Loans for Financial Inclusivity

Did you know ~20-25% of the checking accounts overdrafts? The financial industry is witnessing a transformation in the way overdraft facilities operate. 60% of the Americans have no or less than $1000 of savings in their bank account1. This whitepaper explores the integration of small dollar loans with overdraft services, aiming to provide financial institutions and consumers with a more inclusive, transparent, and sustainable solution.

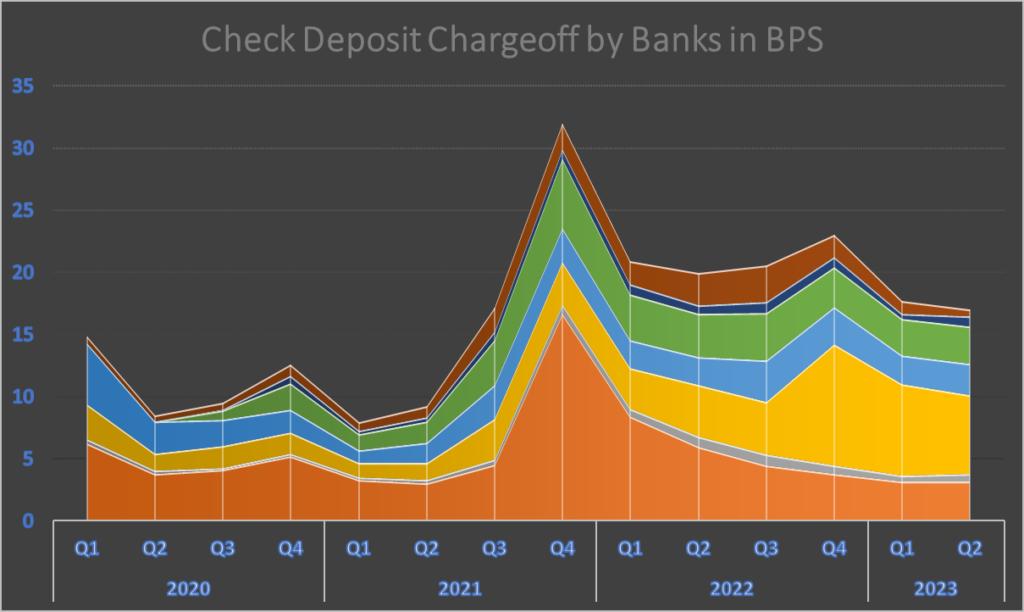

Addressing the Surge in Check Fraud: Innovative Strategies for Modern Financial Security

As financial transactions undergo a transformative shift with the rise of emerging technologies, the assumption that traditional checks are declining has been challenged by a noticeable surge in check fraud.

Eliminating AI biases in Fintech & Banking

In this paper we will cover factors contributing to AI biases, best practices when engineering fair and responsible models, and VALID’s own monitoring study demonstrating model risk performance across income and demographic data.

Behavioral Analytics

While traditional methods like image analysis, account status, and consortium data have been utilized for detecting fraudulent activities, behavioral analytics is emerging as a superior approach with a host of benefits that can add tremendous value.

Check Payments: Innovate the Present to Redefine the Future

Unleashing the Power of Checks in the Modern Era of Digital Payments