Behavioral Analytics

While traditional methods like image analysis, account status, and consortium data have been utilized for detecting fraudulent activities, behavioral analytics is emerging as a superior approach with a host of benefits that can add tremendous value.

A Game-Changer in Check Fraud Detection

When it comes to check fraud, image analysis has been historically leveraged for identifying cases of forgery, counterfeit and alterations. These methods can fall short when it comes to sophisticated fraud methods employed by fraudsters. Incorporating behavioral analytics and intelligent decisioning to look for abnormalities in consumer behavior and detecting fraud enables efficiencies otherwise not achieved by financial institutions. As technological advancements continue to reshape the landscape of the financial industry, the battle against fraud has become a paramount concern. One area of focus is check fraud detection, where the adoption of cutting-edge technologies plays a pivotal role. While traditional methods like image analysis, account status, and consortium data have been utilized for detecting fraudulent activities, behavioral analytics is emerging as a superior approach with a host of benefits that can add tremendous value to existing fraud strategies. In this article, we will delve into the advantages of using behavioral analytics in the realm of check fraud detection.

Understanding Check Fraud Detection

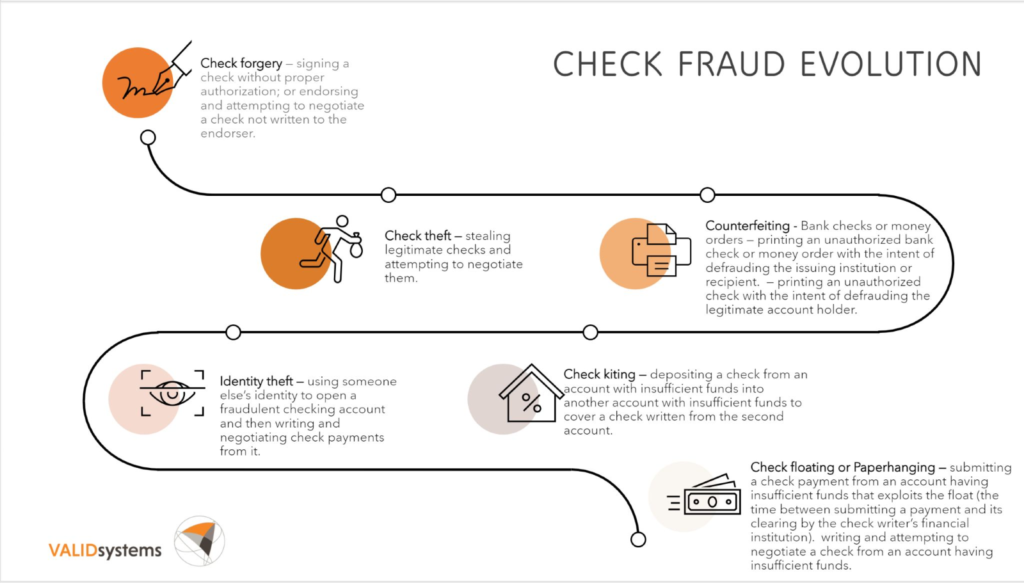

Check fraud is a form of financial crime that involves manipulating checks to steal money from individuals or organizations. It encompasses various techniques, including forging signatures, altering check amounts, and using stolen or counterfeit checks. Detecting these fraudulent activities is crucial to safeguard financial institutions and their clients from substantial financial losses (Exhibit A & B).

To better understand the importance of behavioral analytics and its application we need to highlight the magnitude and evolution of check fraud types.

Exhibit A - Check Fraud Evolution

Let’s not forget that fraudsters are very creative human beings who constantly reinvent themselves. To view check fraud as a static, point-in-time event blinds us to all longitudinal chain of activities that leads to fraud. For example, a non-characteristic, sudden, abnormal deposit of checks, often electronically, followed by rapid withdrawal or transfer of funds is a clear indication of fraud that any image reliant mechanism could fail to detect. Additionally, consortium data might report a good status on each check being presented for deposit knowing that the payer is a good payer. That does not mean that the checks were written to the customer making the deposit and behavioral analytics might tell you as much.

Real-time Anomaly Detection

Unlike day 2 processes and legacy risk tools, behavioral analytics scrutinizes dynamic patterns of user behavior. This real-time analysis enables the detection of anomalies as they occur, empowering institutions to respond swiftly to potential threats.

Contextual Intelligence

Behavioral analytics provides a holistic view of user behavior by considering multiple dimensions such as account level data, payer data, balance patterns., etc. This contextual understanding allows for a more accurate assessment of whether an activity is genuinely suspicious or merely an aberration.

Personalized Fraud Detection

Image analysis lacks the ability to differentiate between users with distinct behaviors, often resulting in false positives and disrupted customer experiences. Behavioral analytics, on the other hand, creates user profiles, allowing institutions to tailor their fraud detection approach to each customer's unique behavior, reducing false positives and enhancing accuracy.

Adaptive Learning

Fraudsters continually evolve their tactics, making it imperative for detection methods to adapt. Behavioral analytics leverages machine learning algorithms to constantly learn from historical data and feedback loops, detect new and emerging threats, making it more resilient to evolving fraud patterns.

Minimized Manual Review Efforts

Image analysis may flag numerous cases requiring manual investigation, leading to resource-intensive processes. Behavioral analytics streamlines the investigative process by pinpointing high-risk activities, enabling fraud teams to allocate their efforts more effectively and efficiently.

Cross-Channel Visibility

Check fraud often extends beyond a single channel, encompassing across mobile, ATM and teller. Behavioral analytics analyzes user behavior across various channels, offering a comprehensive view of fraudulent activities that span multiple touchpoints.

Customer-Centric Approach

Behavioral analytics not only enhances fraud detection accuracy but also fosters a positive customer experience. Reduced false positives lead to fewer disruptions for legitimate customers, promoting customer acquisition and satisfaction.

Conclusion

As the financial industry grapples with the persistent threat of check fraud, the adoption of advanced technologies becomes paramount. While image analysis has played a role in fraud detection, behavioral analytics emerges as a game-changer, offering real-time anomaly detection, contextual intelligence, personalized fraud detection, adaptive learning, and much more. Its ability to adapt to evolving fraud tactics and provide a multi-dimensional view of user behavior makes it a superior choice for organizations seeking to bolster their check fraud detection strategies. In a rapidly changing landscape, behavioral analytics stands as a powerful ally against the ever-evolving challenges posed by check fraud.

Exhibit B - Types of check fraud

| Type | Definition |

| Check forgery | Signing a check without proper authorization; or endorsing and attempting to negotiate a check not written to the endorser. |

| Check kiting | Depositing a check from an account with insufficient funds into another account with insufficient funds to cover a check written from the second account. |

| Check theft | Stealing legitimate checks and attempting to negotiate them. |

| Identity theft | Using someone else’s identity to open a fraudulent checking account and then writing and negotiating check payments from it. |

| Counterfeiting | Printing an unauthorized check with the intent of defrauding the legitimate account holder. |

| Bank checks or money orders | Printing an unauthorized bank check or money order with the intent of defrauding the issuing institution or recipient. |

| Chemical alteration | Using solvents or cleaning agents to wash or alter any or all parts of a legitimate check with the intent of defrauding the account holder, recipient or financial institution. |

| Paperhanging | Writing and attempting to negotiate a check from an account having insufficient funds. |