Overdraft Innovation: Small Dollar Loans for Financial Inclusivity

Did you know ~20-25% of the checking accounts overdrafts? The financial industry is witnessing a transformation in the way overdraft facilities operate. 60% of the Americans have no or less than $1000 of savings in their bank account1. This whitepaper explores the integration of small dollar loans with overdraft services, aiming to provide financial institutions and consumers with a more inclusive, transparent, and sustainable solution.

Did you know ~20-25% of the checking accounts overdrafts? The financial industry is witnessing a transformation in the way overdraft facilities operate. 60% of the Americans have no or less than $1000 of savings in their bank account1. This whitepaper explores the integration of small dollar loans with overdraft services, aiming to provide financial institutions and consumers with a more inclusive, transparent, and sustainable solution.

Overview of the traditional overdraft facilities

An overdraft occurs when a person or business spends more money than is available in their bank account, resulting in a negative balance. Traditionally, banks provide short-term borrowing facilities that allow account holders to withdraw or spend more than the actual balance in their account, up to a specified limit.

Similarly, Non-Sufficient Funds (NSF) occurs when a checking account doesn’t have enough money to cover a transaction and the payment is returned, leading to fee charges on the account.

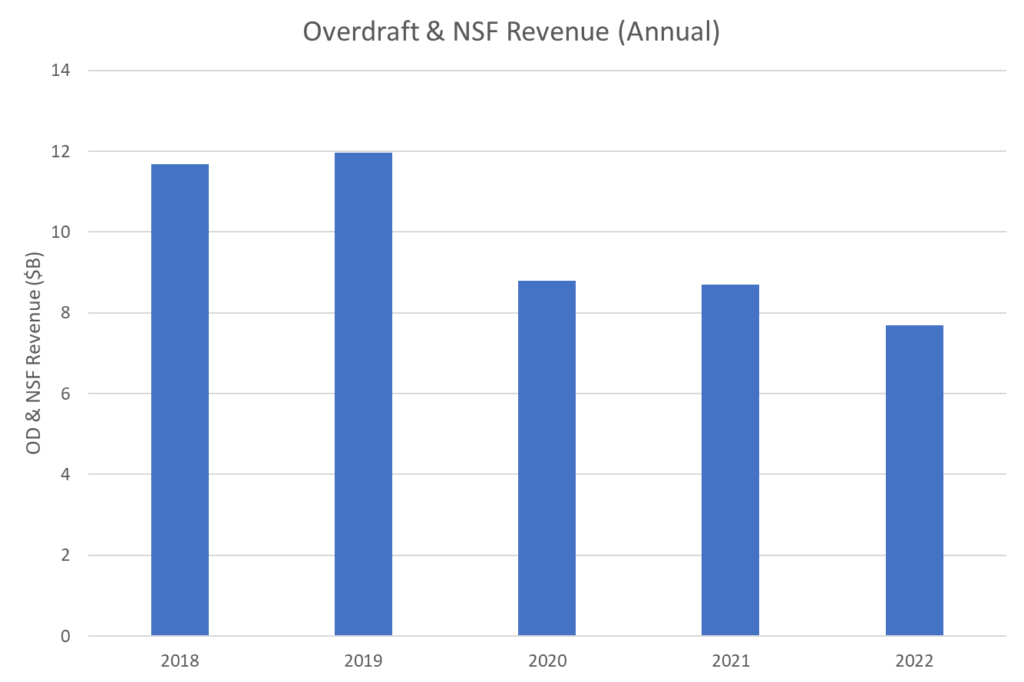

Overdraft/NSF fees have been a significant source of revenue for many banks. According to reports, in 2019, U.S. banks collected around $11.97 billion in overdraft fees which continue to decrease YoY but still totaled $7.7 billion in 2022.

Source: Call Reports of Federal Financial Institutions Examination Council2

Challenges faced by consumers and financial institutions

There are several challenges related to overdraft/NSF fees, even though it is one of the major revenue sources for financial institutions. As usually these fees are per transaction item, so it adds a high financial burden to the customer. For example, imagine you are purchasing a coffee for $5. If the transaction leads to overdraft, then you pay ~$10-35 as additional overdraft fees. In recent years, with the new reforms from the regulators, the overdraft/NSF fees have been reduced and/or eliminated but it still posed several challenges to the customers and financial institutions.

Challenges for Customers:

- Financial Strain: Overdraft fees can be financially burdensome, especially for individuals living paycheck to paycheck. They amplify the cost of small, unintentional overdrafts, leading to a cycle of debt for many consumers, especially for low-income individuals

- Lack of Transparency: Often, customers find it challenging to understand complex fee structures associated with overdrafts. This lack of transparency makes it difficult for them to anticipate and manage their finances effectively.

Challenges for Financial Institutions:

- Regulatory Scrutiny: Financial institutions face increased scrutiny from regulators due to concerns about the fairness and transparency of overdraft fee practices. Regulatory changes or fines can impact revenue streams derived from overdraft fees.

- Customer Attrition: High overdraft fees lead to customer dissatisfaction and erode trust in the institution. Unhappy customers may seek alternative banking options, affecting customer retention rates.

- Operational Costs: Managing overdrafts involves administrative work and resources to handle customer disputes, notifications, and account management, which can add to operational costs.

- Reputation Risk: Excessive or opaque overdraft fees can damage the institution's reputation. Negative publicity or customer complaints may harm the brand image, affecting future business prospects.

To address these challenges requires innovative solutions which prioritize consumer financial well-being while ensuring the sustainability and compliance of financial institutions. Integrating small dollar loans into overdraft services is one such innovative approach.

Market Signals

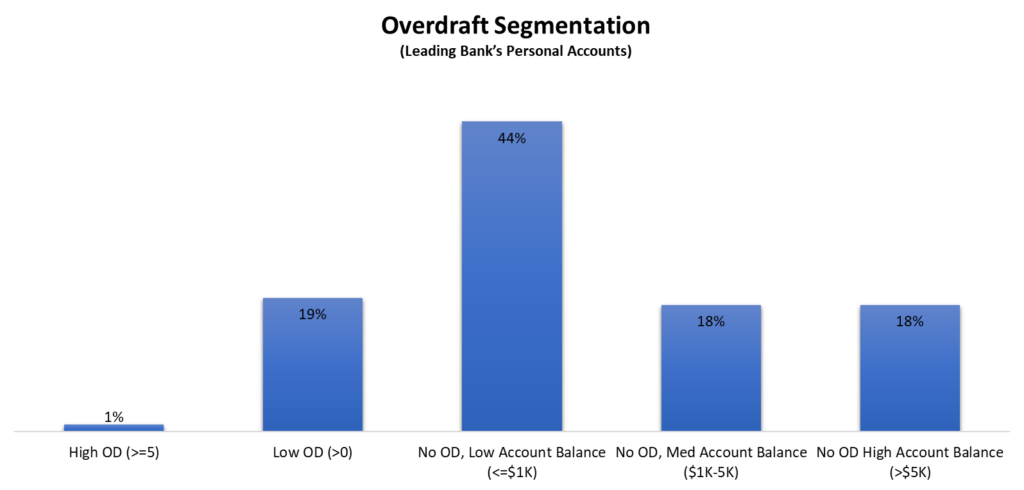

As per study by Ramsey Solutions1, ~60% of Americans have no or less than $1000 of bank savings. We also did an additional study on a leading bank's personal accounts as of 2022. We segmented the accounts into 5 categories based on monthly overdraft count and account balance, and found that

- ~60% of the accounts have overdrafted or account balance < $1000, aligns with study by Ramsey Solutions

- ~20% of the accounts overdrafted

The high overdraft (OD) accounts usually intentionally overdraft to meet emergency fund needs, while low (OD) accounts usually unintentionally overdraft as these people do not check their account balance often.

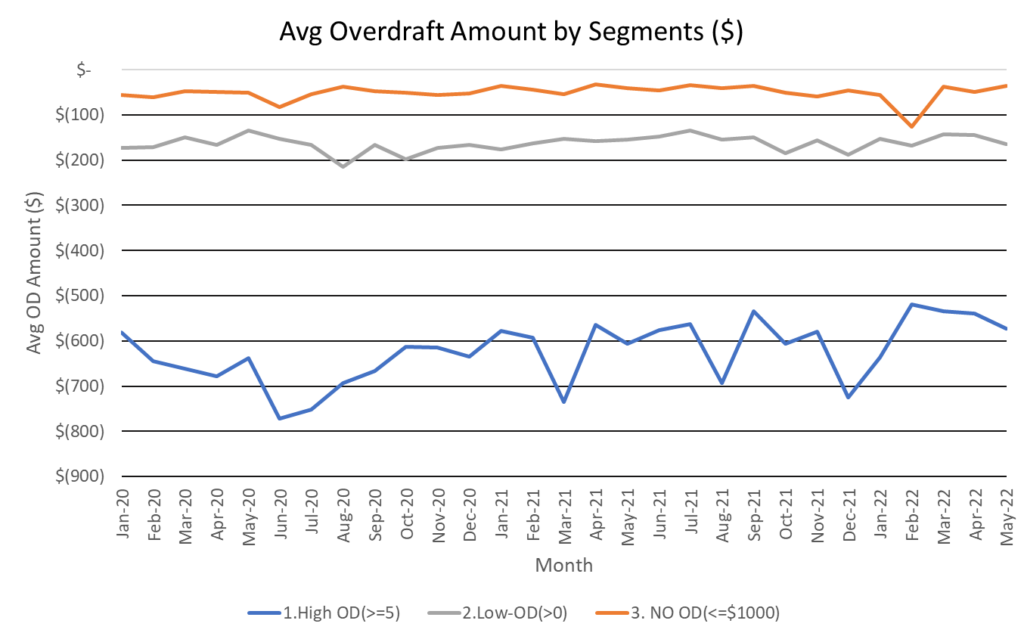

We also observed that average overdraft amount for 3 segments (High Overdrafts, Low Overdrafts and No OD with Account Balance <= $1000) was always < $1000, which signifies that there is a strong need for emergency funds but less than $1000 as small dollar loan. For High OD, the need of SDL is ~4X vs. Low ODs.

The Case for Innovation: Small Dollar Loans (SDL) Integration

Fintech companies and some banks have started offering alternatives to traditional overdraft fees. In 2022, Wells Fargo & Co. introduced a small dollar loan to their consumers as overdraft fees drew scrutiny from regulators. These loans have flat fees for eligible customers, such as $500 loan with a fee of $20. These lower-cost options such as small dollar loans give customers an opportunity to avoid fees, meet emergency situations, and build personal credit profiles enabling financial inclusivity.

Benefits to Consumers:

- Reduced Financial Burden: Small dollar loans often come with lower fees compared to overdraft charges. By integrating these loans, consumers can avoid high overdraft fees, reducing their financial burden.

- Transparent Terms: Small dollar loans typically have clearer terms and fees, providing consumers with more transparency and predictability in their financial obligations compared to complex overdraft fee structures.

- Avoidance of Cycle of Debt: Small dollar loans can be structured with affordable repayment plans, helping consumers avoid the cycle of debt often associated with high overdraft fees.

- Enhanced Financial Stability: Access to small dollar loans can stabilize the financial situation for individuals facing unexpected expenses, providing a safer and more manageable alternative to overdrafts.

Benefits to Financial Institutions:

- Compliance and Regulatory Alignment: Small dollar loans, if structured appropriately, may align better with regulatory guidelines, reducing the regulatory risks associated with overdraft fees.

- Customer Satisfaction and Retention: Offering alternative financial products that are more consumer-friendly can enhance customer satisfaction and loyalty, leading to better retention rates for financial institutions.

- Diversified Revenue Streams: Integrating small dollar loans diversifies the revenue streams for financial institutions beyond traditional overdraft fees, potentially creating more sustainable business models.

Recently, CFPB found that some consumers use overdraft, NSF services as a form of credit6.

Future landscape

Replacing overdraft fees with small dollar loans can benefit consumers by offering immediate funds with potentially lower costs. However, careful consideration of interest rates, debt cycle risks, equitable access, and robust financial education is crucial. Striking a balance between innovation and responsible lending practices is essential to ensure fair terms, prevent perpetual debt cycles, and safeguard consumer welfare in this evolving financial landscape.

We also need reforms in the regulatory to ensure fair lending practices are being followed to prevent customers from offering payday types of loans, which pushes them into a debt cycle.

Conclusion:

Innovation through small dollar loans into overdraft facilities, financial institutions can create more inclusive, transparent, and responsible financial services. This integration benefits both consumers, by offering more affordable and manageable credit options, and financial institutions, by mitigating risks associated with high overdraft fees while fostering a more positive customer relationship and financial inclusivity.

References:

- https://www.nasdaq.com/articles/americans-do-not-have-enough-savings.-heres-what-you-can-do-about-it

- https://www.americanbanker.com/news/cfpb-report-finds-overdraft-nsf-services-are-used-as-a-type-of-credit