Banking is built on managing uncertainty, where every decision carries some level of risk.

From lending and changing market conditions to cyber threats and regulatory pressures, banks face a wide range of challenges that can impact profitability and stability.

Understanding different types of risk and knowing how to prevent or respond to them is what separates resilient financial institutions from vulnerable ones.

In this article, we explore the seven main types of risk in banking and the strategies that can help manage them effectively.

Key takeaways

- Credit risk remains the biggest balance-sheet threat

Even in stable environments, borrower stress leads to missed payments. Strong underwriting, continuous monitoring, realistic stress testing, and risk-based pricing are essential to protecting capital and earnings.

- Market and liquidity risks are tightly linked and can escalate quickly

Rising interest rates can erode asset values while sudden deposit outflows strain liquidity. Diversification, hedging, clear risk limits, and well-tested contingency funding plans are critical defenses.

- Operational risk and fraud are inevitable

Unlike other risks, operational losses will occur. Fraud across checks, wires, ACH, and accounts is a persistent drain, and reactive controls leave banks exposed to repeat losses and customer harm.

- Compliance and environmental, social, and governance risks drive financial and reputational outcomes

Regulatory failures and weak governance can trigger massive fines and long-term trust damage. Proactive compliance monitoring, role-based training, strong governance, and transparent practices reduce both regulatory and reputational fallout.

- Real-time fraud prevention is the most actionable risk lever banks can pull

Policies and reviews cannot stop fraud after the fact. VALID embeds real-time, validated fraud decisioning directly at the point of deposit, stopping losses before they occur.

7 Types of risks in banking: An overview

Here is a quick overview of what the main risks in banking are and why you should be aware of them:

|

Risk type |

What it is |

Why it matters |

|

Credit risk |

Risk that borrowers fail to repay loans or meet contractual obligations |

Directly impacts profitability and capital through loan losses |

|

Market risk |

Risk of losses from changes in interest rates, market prices, or currencies |

Can significantly reduce the value of trading and investment portfolios |

|

Operational risk |

Risk from internal process failures, human error, system breakdowns, or fraud |

Leads to financial losses, fraud exposure, and operational disruption |

|

Compliance risk |

Risk of legal, financial, or reputational harm from regulatory noncompliance |

Can result in heavy fines, sanctions, and regulatory scrutiny |

|

ESG risk |

Risk from environmental, social, and governance factors |

Affects long-term financial performance and reputation |

|

Liquidity risk |

Risk of being unable to meet short-term obligations or withdrawals |

Threatens solvency and customer confidence during stress events |

|

Reputational risk |

Risk of loss of public trust and brand damage |

Can trigger customer churn, funding pressure, and regulatory attention |

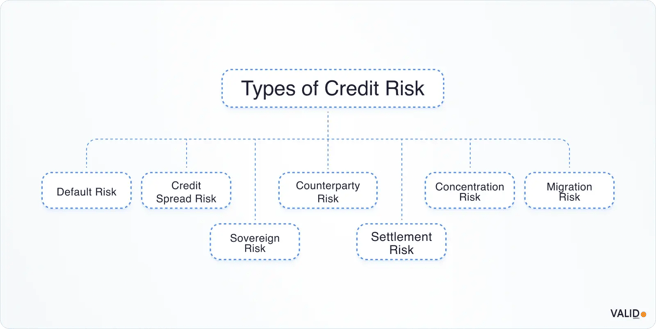

1. Credit risk

Credit risk is the most significant risk banks face. It occurs when borrowers or counterparties fail to meet their contractual obligations, such as missing principal or interest payments on mortgages, credit cards, or other loans.

In the third quarter of 2025, about 1.47% of all loans at US commercial banks were past due, highlighting banks’ continued exposure to credit risk as borrowers struggle to make on-time payments.

How to manage this risk:

- Robust underwriting standards: Apply disciplined credit standards by carefully evaluating each borrower’s ability to repay. Use realistic assumptions, and require adequate collateral or guarantees to avoid taking on excessive risk.

- Continuous monitoring: Implement automated monitoring tools that track payment behavior, covenant compliance, financial statement updates, and credit score changes. Use early-warning triggers (missed payments, declining cash flow, covenant breaches) to prompt proactive actions such as borrower outreach or loan restructuring.

- Loan loss reserves & stress testing: Calculate reserves using forward-looking credit loss models (such as CECL) that incorporate macroeconomic scenarios. Stress-test the portfolio under tough conditions to ensure the bank has sufficient capital even during downturns.

- Risk-based pricing: Price loans according to their underlying risk by aligning interest rates, fees, and loan terms with the borrower’s credit profile. This helps you earn higher returns on riskier loans while avoiding deals that do not adequately compensate for the risk taken.

2. Market risk

Market risk is the potential for losses caused by changes in market prices and interest rates. Banks are exposed through trading activities, investment portfolios, and interest rate movements affecting their balance sheets.

As of the end of 2024, US banks held about $481 billion in unrealized losses on securities due to higher interest rates reducing the market value of fixed-income assets.

How to manage this risk:

- Portfolio diversification: Spread investments across different asset classes, industries, regions, and currencies to reduce the impact of losses in any single area.

- Risk hedging: Use financial instruments such as futures, options, and swaps to protect against unfavorable movements in interest rates, foreign exchange rates, or market prices.

- Risk limits and monitoring: Set clear risk limits and closely monitor exposures using measures like Value at Risk (VaR) to keep market risk within acceptable levels.

- Stress testing and scenario analysis: Conduct regular stress tests under extreme but realistic market conditions to identify weaknesses and plan effective responses.

3. Operational risk

Operational risk refers to losses caused by failures in internal processes, human error, and system breakdowns. It can also include external events, including:

- Check fraud

- ACH and wire fraud

- Card fraud

- Identity fraud

- Account takeover

Unlike credit or market risk, operational risk is unavoidable in complex organizations. In fact, 79% of credit union and community bank leaders said their organizations lost more than $500,000 to fraud in 2023.

How to manage this risk:

- Strong internal controls and audits: Establish strong internal controls, such as separating duties so no single employee can initiate and approve high-value transactions. Support these controls with regular audits to identify weaknesses early.

- Employee training and accountability: Provide ongoing training on procedures, cybersecurity, and fraud awareness, and reinforce accountability through clear roles and root-cause analysis of errors.

- Digital access controls: Use tools like multi-factor authentication, device fingerprinting, and behavioral biometrics to prevent unauthorized account access and payment fraud.

- Fraud detection and monitoring: Deploy layered security, transaction monitoring, and advanced analytics or AI to detect suspicious activity in real time.

- Fraud intelligence sharing: Collaborate with other banks and industry groups to share fraud trends and threat intelligence, helping prevent fraud from spreading across institutions.

Pro tip

Many banks manage operational risk reactively, relying on after-the-fact reviews. VALID takes a different approach by embedding real-time, validated fraud decisioning directly into check and payment workflows, reducing human error, system gaps, and residual fraud exposure.

VALID’s platform combines machine learning, behavioral analytics, and cross-institution intelligence to detect and stop fraud at the point of deposit.

Contact us today to see how VALID’s real-time fraud decisioning platform helps banks control operational risk before losses occur.

4. Compliance risk

Compliance risk refers to the legal, financial, and reputational harm a bank may face if it fails to comply with laws, regulations, or industry standards.

Operating in a highly regulated environment, financial institutions must comply with requirements related to:

- Consumer protection

- Anti-money laundering (AML)

- Economic and trade sanctions

- Data privacy and information security

Failure to comply with these regulations can result in severe consequences, including billions of dollars in fines. For example, BNP Paribas paid approximately $9 billion for sanctions violations, while JPMorgan Chase settled for $13 billion due to mortgage-related misconduct.

How to manage this risk:

- Stay current on regulatory requirements: Actively track changes from regulators such as the CFPB, OCC, Federal Reserve, and FinCEN, and promptly update policies, procedures, and training to reflect new rules.

- Train employees by role: Provide regular, role-based training on BSA/AML, KYC, fraud prevention, and fair lending. Ensure front-line staff know how to identify and escalate suspicious activity through annual refresher sessions or certifications.

- Monitor and test compliance: Use transaction monitoring and other RegTech tools to flag unusual activity, and perform periodic internal or third-party audits to confirm adherence to laws and internal policies.

- Regulatory exam readiness: Maintain well-organized documentation, conduct mock exams, and proactively report issues and remediation to regulators to reduce supervisory risk.

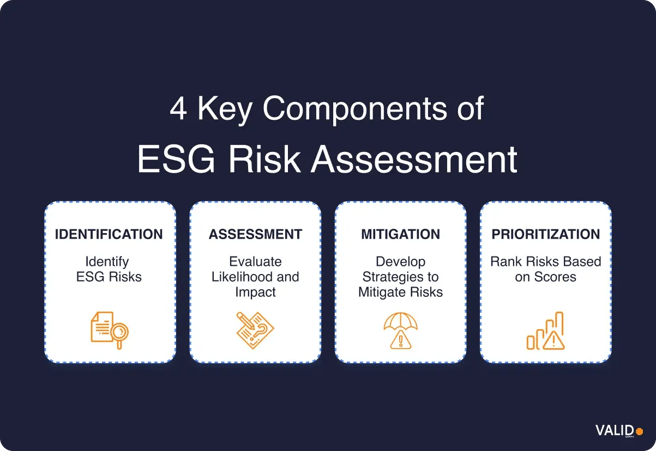

5. Environmental, social, and governance risks

Environmental, social, and governance (ESG) risks are typically grouped into three categories that can harm a bank’s financial performance or reputation:

- Environmental risk: Exposure to climate-related and environmental factors, such as lending on properties in flood zones or to carbon-intensive industries facing transition and regulatory risks

- Social risk: Risks related to the bank’s treatment of customers, employees, and communities, including issues like unfair practices or negative social impact

- Governance risk: Risks arising from weak governance, ethics, or oversight, which can lead to fraud, scandals, mismanagement, and reputational damage

How to manage these risks:

- Integrate ESG into risk management: Embed ESG risks into day-to-day risk management by stress-testing portfolios for climate impacts and monitoring social and governance risks early.

- Enhance ESG disclosure and transparency: Measure and clearly disclose ESG metrics such as financed emissions, diversity data, and governance practices to meet regulatory expectations and improve internal risk oversight.

- Develop responsible banking policies: Set clear ESG policies, including net-zero commitments, exclusion lists, and fair-lending standards, to guide decision-making and manage risk consistently.

- Engage with stakeholders: Maintain regular dialogue with investors, regulators, employees, and communities to identify emerging ESG risks and address concerns proactively.

6. Liquidity risk

Liquidity risk is the possibility that a bank cannot meet its short-term payments, meaning it may not have enough cash or easily available funds to pay depositors and creditors.

Because banks use short-term deposits to make long-term loans, they can face serious problems if too many customers try to withdraw money at the same time.

For example, in 2023, the collapse of Silicon Valley Bank forced many banks to turn to the Federal Reserve for funding, showing why banks must keep enough liquid funds to handle sudden withdrawals.

How to manage this risk:

- Maintain high-quality liquid assets (HQLA): Hold sufficient easily saleable or pledgeable assets to ensure the bank’s Liquidity Coverage Ratio (LCR) remains well above minimums and provides protection during stress periods.

- Diversify funding sources: Use a balanced mix of deposits, wholesale funding, and backup credit lines to limit exposure if any single funding source withdraws.

- Contingency funding plan: Keep a clear, tested plan for accessing emergency liquidity, through central bank facilities or asset sales, so actions can be taken quickly under pressure.

- Manage liquidity ratios and early warning indicators: Track key liquidity ratios and warning signals, including the loan-to-deposit ratio, LCR, Net Stable Funding Ratio (NSFR), large or sudden deposit withdrawals, and rising funding costs.

7. Reputational risk

Reputational risk refers to the potential loss of public trust or damage to a bank’s brand, leading to customer attrition, reduced business, and increased regulatory oversight.

This decline in trust and reputation can quickly translate into customer churn and long-term damage to the bank’s market position.

How to manage this risk:

- Ethical culture and governance: Promote integrity through clear codes of conduct, strong leadership examples, and active board oversight to prevent misconduct and scandals.

- Customer service and issue resolution: Prioritize customer concerns with simple, fast, and fair resolution processes to stop small issues from escalating.

- Media and social monitoring: Regularly monitor news and social media to identify and address emerging reputational risks early.

- Transparent communication: Address issues openly by acknowledging problems, explaining actions taken, and providing timely updates.

- Community trust and goodwill: Build reputational resilience through genuine community involvement, responsible practices, and strong regulatory relationships.

One banking risk you don’t have to accept: Real-time fraud prevention with VALID

While most banking risks can be mitigated through policies, capital buffers, and oversight, operational risk is different. Fraud is always a possibility. What matters is whether you react after the loss or stop the risk the moment it’s introduced.

When operational risk isn’t controlled in real time, the consequences go far beyond financial loss, leading to customer frustration, regulatory scrutiny, and lasting reputational damage.

Why leading institutions are choosing VALID

Stopping fraud isn’t about adding another post-deposit alert or manual review queue. It’s about shifting the moment of decision to the exact point where risk is introduced.

VALID does precisely that, operating in real time, at deposit presentment, before funds are released and before losses occur.

Trusted by top financial institutions processing over $4 trillion in annual check volume, VALID is purpose-built for environments where delay, guesswork, and after-the-fact detection are no longer acceptable.

Here is what VALID can do for you:

- Real-time decisioning at the point of deposit: VALID’s patented Real-Time Loss Alerts (RTLA) and CheckDetect evaluate every deposit instantly across mobile, ATM, and branch channels. Banks can approve, hold, or decline deposits in the moment, eliminating delayed decisions, downstream losses, and unnecessary customer friction.

- Guaranteed risk protection: VALID doesn’t stop at detection. If a deposit item approved by VALID results in a covered loss, VALID absorbs the loss, effectively removing that operational and financial risk from the bank’s balance sheet.

- Machine learning that goes beyond the check image: While traditional tools focus heavily on image analysis, VALID evaluates risk using a richer, multidimensional lens, including:

- Behavioral analytics

- Payer–payee relationships

- Transaction context and velocity

- Cross-institution intelligence from the Edge Data Consortium

This approach captures up to 95% of fraud losses while alerting on just 0.5% of items, dramatically reducing false positives and manual reviews.

- Proven, measurable impact at scale: VALID delivers results that go beyond theory:

- 74% year-over-year fraud loss reduction at PNC

- Fraud loss rates reduced from 22 bps to 2 bps at FNB

- 75% reduction in manual fraud review time at Commerce Bank

Contact us today to see how real-time fraud decisioning can help you proactively control operational risk before losses occur.

FAQ:

1. What is the most significant risk banks are facing today?

Historically, credit risk has been the top concern for banks. However, as banking services become increasingly digital, many experts now view cybersecurity and operational risks as the most significant threats.

2. What role does third-party risk management play in banking?

Third-party risk management focuses on identifying and reducing operational, cybersecurity, or compliance risks that come from outsourcing services to external vendors.

Banks address these risks by performing thorough due diligence, establishing clear contractual requirements, and continuously monitoring vendor performance.

3. What are key risk indicators in banking?

Key risk indicators (KRIs) are metrics used to track and assess potential risks within a bank. They measure both the likelihood of a risk event occurring and the potential impact if it does.