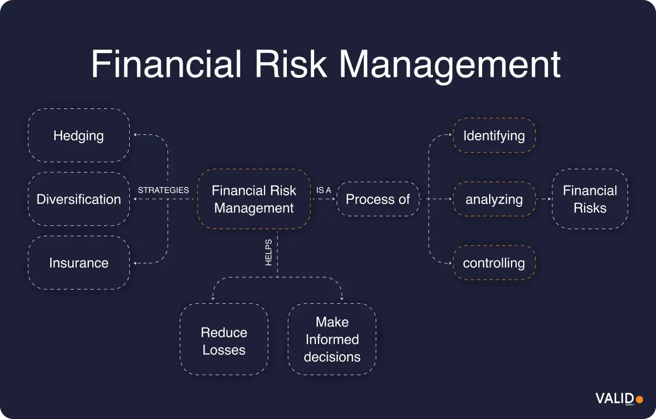

Financial risk today is driven by what happens inside each transaction. Fraud attempts, risky deposits, model drift, and slow operational workflows create exposure long before balance-sheet metrics ever show it. Institutions no longer struggle with market swings or credit cycles; they struggle with detecting bad checks early, deciding funds availability safely, and ensuring that models and controls work the moment risk appears.

Modern financial risk centers on transaction signals, rising fraud activity, deposit verification weaknesses, and the pressure to offer instant funds safely. Institutions must also manage model and operational failures, along with compliance expectations for consistent, well-documented fraud controls.

Institutions that manage these risks in real time prevent losses, accelerate safe deposits, and maintain operational resilience. This article outlines financial risk management strategies that reduce fraud, strengthen real-time decisioning, and protect every transaction with proactive, data-driven controls.

Key takeaways:

- Understand how financial risks connect: Financial risk affects every part of performance. Recognising how market, credit, liquidity, operational, and regulatory risks interact helps institutions predict pressure points early and build a more balanced risk profile.

- Follow a structured risk management process: Managing risk is not a single event but a continuous cycle. Identify exposures, assess and quantify impact, decide on mitigation or transfer, and monitor outcomes.

- Adopt dynamic financial risk management strategies: Risk evolves in real time. The best-performing institutions use data, analytics, and automation to detect exposures early, diversify intelligently, and stress-test regularly.

- Build resilience through culture and preparation: Frameworks only work when teams act on them. Embedding accountability, training staff to recognise early warning signs, and maintaining continuity plans ensure that resilience is part of everyday operations, not just recovery after a crisis.

- Make financial risk management strategies proactive with VALID Systems: VALID Systems helps institutions move from static oversight to continuous control. Its real-time decisioning and automation tools allow financial teams to detect risk early, strengthen liquidity management, and prevent losses before they occur.

Understanding financial risk

Modern financial risk is defined by what happens inside each transaction and each deposit, not by market cycles or portfolio movements. Fraud attempts move in real time, funds availability decisions happen in seconds, and any operational delay can convert a small signal into a charge-off. Institutions that understand these risks at the transaction layer gain control long before losses surface in financial results.

Key types of financial risk that matter today:

- Fraud risk: The fastest-growing source of loss for banks, credit unions, and fintechs. Check fraud, mule activity, account takeover, and first-party abuse all introduce direct financial exposure if not detected before posting.

- Transaction and payment fraud risk: Each payment or deposit carries behavioural and contextual cues that signal risk. Weak scoring or slow manual review allows fraudulent items to clear, increasing loss rates and operational strain.

- Check and deposit-verification risk: Altered, counterfeit, and washed checks continue to rise. Exposure grows when high-risk items are released before verification, or when models fail to detect anomalies in the deposit stream.

- Deposit availability risk: Customers expect funds immediately, but granting early access without strong analytics can accelerate loss. Safe acceleration depends on real-time scoring, historical behaviour profiling, and automated risk controls.

- Operational risk: Breakdowns in workflows, delays in exception handling, inconsistent review processes, and disconnected systems create avoidable exposure. The longer a risky item sits unattended, the higher the loss probability.

- Model risk: Models that score deposits or transactions can drift, misclassify, or fail as fraud patterns evolve. Without continuous monitoring and recalibration, even strong models lose effectiveness over time.

- Regulatory and audit risk (fraud-focused): Regulators expect institutions to detect fraud consistently, document controls, and prove that decisioning is fair, defensible, and repeatable. Missing evidence or inconsistent execution leads to findings, penalties, and reputational issues.

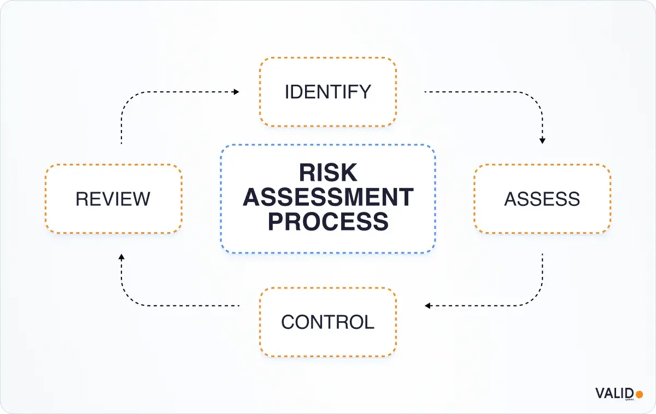

The risk management lifecycle

The process of managing risk follows a clear progression:

- Identify: Map exposures across all functions and entities. Understanding the source of risk enables management to allocate resources efficiently.

- Assess and Quantify: Measure potential impact using structured methods, such as Value-at-Risk, stress tests, and scenario analysis. Quantification provides the foundation for objective decision-making.

- Decide Strategy: Determine the appropriate response – mitigate, transfer, or retain exposure, and define policies and limits to guide execution.

- Monitor and Report: Continuously track changes in exposure, performance, and control effectiveness. Reporting links front-line data with board-level oversight and ensures accountability across the organization.

15 financial risk management strategies to reduce risk

In 2024, consumer fraud losses exceeded $12 billion, up 25% year over year.

Financial risk today evolves in real time. Institutions that survive and scale are those that manage risk dynamically: detecting exposures early, quantifying impact fast, and executing consistently across teams.

These 15 financial risk management strategies combine proven frameworks with modern data, analytics, and automation – turning risk from a compliance exercise into a decision advantage:

1. Use real-time fraud scoring on every deposit and transaction

Real-time scoring is the foundation of modern fraud prevention. Instead of waiting for overnight routines or manual review queues, institutions evaluate each deposit at the moment of capture. By combining historical behaviour, transaction-level attributes, and image analytics, real-time scoring prevents fraudulent items from reaching the ledger.

Action steps:

- Deploy real-time scoring for mobile, ATM, teller, and RDC deposits.

- Incorporate behavioural and historical risk variables into every score.

- Route items instantly into approve, hold, or reject workflows.

Pro tip:

CheckDetect evaluates each check in real time and identifies altered, counterfeit, and suspicious items before posting.

2. Segment transactions to detect high-risk patterns early

Fraud rarely distributes evenly. Specific customer segments, channels, and deposit patterns carry higher concentrations of risk. Segmentation reveals where fraud clusters and allows institutions to focus enhanced controls without slowing the entire system.

Action steps:

- Segment by deposit channel, account age, customer profile, and velocity.

- Track fraud concentrations weekly to identify emerging hotspots.

- Apply enhanced verification only to high-risk segments.

Pro tip:

Segmenting by account age, rapid activity changes, or inconsistent check origins often surfaces risk earlier than model scoring alone.

3. Strengthen counterfeit, altered, and washed check detection

Image-based attacks continue rising because they exploit institutions that rely on manual visual review. Advanced image analytics detect irregularities that the human eye cannot reliably identify.

Action steps:

- Combine image forensics with transactional and behavioural signals.

- Flag inconsistencies in handwriting, MICR data, signatures, and fields.

- Apply automated holds when authenticity signals fail.

Pro tip:

CheckDetect uses image analysis models trained on millions of confirmed fraud cases, improving detection accuracy.

4. Profile deposit behaviour to catch first-party fraud and mule activity

Behavioural anomalies often reveal risk before transactional attributes do. Sudden spikes in activity, unusual deposit timing, or inconsistent check origins frequently indicate first-party fraud, synthetic identities, or mule accounts.

Action steps:

- Build normal baselines for deposit frequency and size.

- Detect rapid increases or pattern breaks instantly.

- Trigger verification workflows for significant behaviour shifts.

Pro tip:

Behavioural drift, meaning a sudden change from baseline patterns, is one of the most reliable early indicators of mule activity.

5. Use velocity, anomaly, and pattern detection for early warning

Fraud activity tends to accelerate quickly. Velocity controls catch rapid transaction bursts, repeated deposits, circular activity, or sequences that resemble known fraud typologies. These signals help institutions intervene before losses escalate.

Action steps:

- Monitor deposit velocity by customer, channel, and geography.

- Flag accounts with repeated near-miss fraud or return activity.

- Combine velocity data with anomaly scoring to highlight suspicious patterns.

Pro tip:

Use velocity spikes as auto-escalation triggers. Fraud rings often test an account several times before a large strike.

6. Automate holds and funds availability decisions

Fund availability is one of the largest sources of deposit risk. Automated decisioning ensures consistency, speeds processing for low-risk deposits, and reduces exposure caused by slow or inconsistent manual decisions.

Action steps:

- Tie availability rules directly to risk-model outputs.

- Reduce manual overrides and track justification when they occur.

- Apply standard hold durations based on verified risk tiers.

Pro tip:

InstantFUNDS allows institutions to accelerate safe deposits immediately while maintaining complete protection on high-risk items.

7. Monitor model drift and recalibrate continuously

Models lose accuracy as fraud patterns evolve. Drift monitoring ensures that scoring engines maintain precision, especially during rapid changes in customer behaviour or fraud typologies.

Action steps:

- Track false positives, false negatives, and override rates.

- Monitor model performance across channels and customer segments.

- Recalibrate scoring models frequently and after pattern changes.

Pro tip:

Silent failures, meaning risky items approved by the model but later returned, are the strongest indicator of model drift.

8. Automate exception queues and prioritise by risk level

High-risk deposits become more dangerous the longer they sit in a queue. Automated triage ensures that the most urgent items receive immediate attention, while low-risk items clear without unnecessary delay.

Action steps:

- Assign risk tiers using automated scoring thresholds.

- Push high-risk items into immediate review.

- Track queue ageing and end-to-end decision latency.

Pro tip:

Institutions that automate queue triage significantly reduce losses by shortening time-to-action at peak volumes.

9. Strengthen fraud escalation governance

Losses often occur because escalations happen too slowly or inconsistently. Transparent escalation governance ensures that the correct people act at the proper time with the authority needed to prevent exposure.

Action steps:

- Define escalation criteria for high-risk deposits and fraud alerts.

- Give fraud teams the authority to pause funds availability when needed.

- Track timing from alert to escalation to final resolution.

Pro tip:

Escalation outcomes improve when authority sits with the operational team closest to the transaction rather than only with senior leadership.

10. Move to continuous monitoring and real-time feedback loops

Fraud patterns change rapidly, and waiting for weekly or monthly reviews leads to preventable losses. Continuous tracking provides visibility into emerging patterns and improves the accuracy of future decisioning.

Action steps:

- Refresh fraud dashboards daily or intra-day.

- Conduct rolling reviews of high-risk segments every 90 days.

- Use incident data to retrain or adjust scoring models.

Pro tip:

Set automated alerts for pattern drift to ensure that analysts intervene before loss rates increase.

11. Develop fraud-specific KRIs

Generic key risk indicators (KRIs) do not highlight transaction-level risk. Fraud-specific KRIs provide early signals when exposure is increasing or when operational processes are slowing down decision-making.

Action steps:

- Track fraud attempt velocity, high-risk deposit volume, and model overrides.

- Monitor return rates, exception queue ageing, and decision latency.

- Assign owners and action thresholds for every KRI.

Pro tip:

KRIs based on latency, meaning how long it takes to act, are often more predictive than KRIs based on event frequency.

12. Align fraud and deposit controls with regulatory expectations

Regulators closely evaluate fraud detection, model governance, documentation, escalation procedures, and decisions on funds availability.

Institutions need consistent, traceable, and well-documented controls.

Action steps:

- Maintain real-time audit logs for every availability and risk decision.

- Document model governance, validation schedules, and recalibration cycles.

- Map deposit availability decisions to Reg CC and internal fraud controls.

13. Train frontline, back-office, and fraud teams using live scenarios

Teams need hands-on exposure to real situations, not abstract policy descriptions. Scenario-based training builds instinctive recognition of fraud patterns and reduces error rates during actual events.

Action steps:

- Embed short, scenario-based modules into workflow tools.

- Train staff using real fraud events and live dashboards.

- Run cross-team simulations on a regular schedule.

14. Build operational resilience in the deposit flow

Operational failures create immediate fraud exposure. Resilience ensures that deposit controls remain effective even during system outages, staffing shortages, or volume spikes.

Action steps:

- Stress-test deposit workflows under peak load.

- Validate backup systems for scoring and exception routing.

- Ensure continuity plans are shared across fraud, operations, and treasury.

Pro tip:

Measure the estimated loss per minute during outages to justify resilience investments to leadership.

15. Produce fraud-focused reporting that accelerates decisions

Reporting must guide shifting. Clean, focused dashboards help leadership understand current fraud pressures, operational performance, and emerging patterns, enabling them to respond quickly.

Action steps:

- Use one-page risk summaries with heat maps and KRI tables.

- Pull all data directly from live systems to avoid manual delays.

- Assign every action item to an owner and track deadlines.

How VALID Systems strengthens your financial risk management strategies

Across these fraud-focused risk strategies, two capabilities are essential: real-time detection and real-time decisioning. With every minute of delay, exposure grows, and losses follow.

VALID Systems equips institutions to act with precision the moment risk surfaces:

- Prevent losses in the deposit flow: CheckDetect analyzes each check in real time, identifying high-risk items before they post and preventing charge-offs before they affect the balance sheet.

- Accelerate funds without increasing exposure: InstantFUNDS offers customers immediate access to verified deposits while maintaining control over risk. Up to 99% of deposits are approved instantly with complete loss protection.

- Turn strategy into operation: These solutions transform financial risk management strategies from framework to practice. Fraud prevention, liquidity control, and decision clarity all become part of everyday operations, not just quarterly reviews.

VALID Systems empowers banks, credit unions, and fintechs to stay ahead of risk, protect every transaction, and build resilience across their portfolios.

Make financial risk management strategies proactive rather than reactive.

Learn how VALID Systems prevents fraud before it reaches the books and strengthens control across every transaction.