When talking about risks in banking, people usually refer to financial risks, such as credit and market risks, and for a good reason. They can cause significant losses, threaten profitability, and destabilize financial institutions.

However, there are many other types of risks that can cause harm on the same scale and, in some cases, have even more severe consequences.

These non-financial risks often stem from people-related factors, processes, systems, or external events and are harder to quantify but just as critical to manage.

In this article, we will explore non-financial risk management by examining six key types of risks and ways to manage them.

Key takeaways

- Non-financial risks can be just as dangerous as financial ones

Risks like cybersecurity, fraud, compliance, and operational failures may not appear in financial statements but can still disrupt operations, undermine trust, and threaten long-term stability.

- Cybersecurity and fraud are now top-tier bank risks

Cybersecurity and fraud risk consistently rank as the most critical non-financial risks for banks. These threats move quickly, exploit short control gaps, and often lead to customer harm, regulatory scrutiny, and reputational damage.

- Operational and compliance failures compound quickly

Breakdowns in processes, systems, or regulatory controls rarely stay isolated and can result in outages, fines, and costly remediation.

- Third-party risk extends your risk perimeter

Vendor failures or security weaknesses can disrupt operations and expose data, making strong due diligence, monitoring, and exit planning essential.

- Stopping fraud early is the most effective risk control

Traditional controls are reactive. VALID applies real-time decisioning inside payment and deposit workflows, reducing fraud losses while preventing downstream operational, compliance, and reputational risk.

What are non-financial risks?

Non-financial risks are threats that don’t directly appear in an organization’s financial statements but can still seriously affect business performance and continuity.

They broadly include risks that fall outside traditional market, credit, and liquidity categories and encompass a wide range of organizational vulnerabilities.

If not properly managed, these risks can undermine trust, disrupt operations, and threaten long-term stability.

Non-financial risk management: 6 Types of non-financial risks and how to manage them

Before exploring different types of non-financial risks in banking, here is a quick overview of what they include:

|

Risk type |

What it is |

Why it matters |

|

Cybersecurity and IT risk |

Risk of losses from data breaches, hacking, ransomware, system failures, or technology outages |

Can disrupt customer access, expose sensitive data, trigger regulatory action, and cause severe financial and reputational damage |

|

Fraud risk |

Risk of losses from fraud, money laundering, terrorist financing, bribery, or other illegal activity |

Drives direct financial losses, regulatory penalties, and increased scrutiny, while undermining trust in payment and banking systems |

|

Operational risk |

Risk arising from failures in processes, systems, human factors, or external events |

Leads to service disruptions, financial losses, customer dissatisfaction, and costly recovery efforts |

|

Compliance risk |

Risk of legal or regulatory penalties due to noncompliance with laws and regulations |

Can result in heavy fines, enforcement actions, remediation costs, and long-term regulatory oversight |

|

Reputational risk |

Risk of damage to public trust and the bank’s brand from negative events or perceptions |

Can accelerate customer attrition, funding pressure, and regulatory attention |

|

Third-party and vendor risk |

Risk that external vendors or service providers fail to meet security, operational, or regulatory expectations |

Vendor failures can quickly disrupt operations, expose customer data, and create compliance breaches beyond the bank’s direct control |

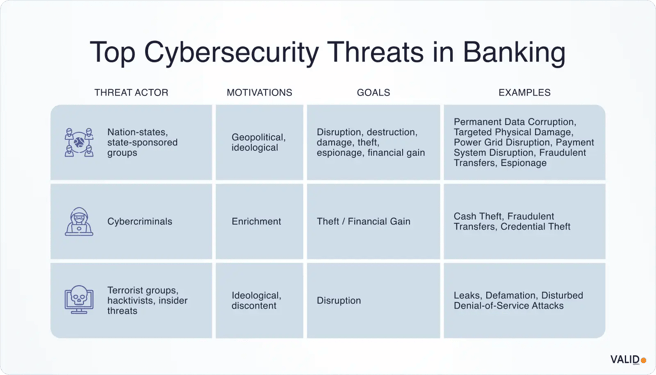

1. Cybersecurity and IT risk

Cybersecurity and IT risk covers losses from data breaches, hacking, ransomware, and failures of information systems. These incidents can disrupt customer access, compromise sensitive data, and cause significant financial and reputational damage.

For US banks, it is now the most significant non-financial risk, with 40–60% of bankers ranking cybersecurity as their top concern and 63% of bank CROs identifying it as a top-tier risk in 2024.

How to manage it:

- Layered security controls: Use a defense-in-depth approach with firewalls, intrusion detection, anti-malware, encryption, and secure network architecture aligned with NIST and FFIEC guidance.

- Patch management and secure configuration: Regularly patch systems and review configurations across on-premise and cloud environments to close vulnerabilities that attackers commonly exploit.

- Continuous monitoring and testing: Conduct ongoing vulnerability scans, penetration testing, and automated monitoring to detect anomalous activity and respond quickly to threats.

- Employee cybersecurity awareness: Train employees on phishing, credential security, and safe system use, and reinforce their training through regular simulations and clear reporting channels.

- Incident response planning: Maintain and regularly test a documented incident response plan that defines roles, escalation paths, and communication requirements with customers and regulators.

2. Fraud risk

In the US, payment fraud has become widespread, with 79% of organizations reporting they have either experienced or been targeted by attempted payment fraud.

As a result, risk officers rank fraud as the second-most significant non-financial risk, appearing on 42% of top risk lists.

How to manage it:

- Robust transaction monitoring: Use automated, real-time systems with rules and machine learning to detect suspicious transactions.

- Know Your Customer (KYC) and AML controls: Verify customer identities and understand how their businesses operate, including who ultimately owns or controls them. Continuously screen customers against sanctions lists and make sure to meet all BSA/AML reporting requirements.

- Employee fraud prevention: Implement strong internal controls such as duty rotation, daily reconciliations, segregated approvals, and regular audits to deter and detect fraud.

- Data analytics and AI tools: Leverage advanced analytics and AI to identify complex fraud patterns and connections across large datasets that traditional monitoring may miss.

- Information sharing and law enforcement coordination: Participate in industry information-sharing forums and promptly report incidents to regulators and law enforcement to support investigations and demonstrate compliance.

Pro tip

To truly reduce fraud, you need tools that react in real time, before the risk fully materializes.

VALID supports financial institutions by applying real-time, validated fraud decisioning within check and payment workflows.

By combining machine learning, behavioral analytics, and cross-institution intelligence, VALID helps identify higher-risk activity earlier in the payment process, reducing downstream losses and manual intervention.

With this approach, VALID accomplished:

- 74% year-over-year fraud loss reduction at PNC

- Fraud loss rates reduced from 22 bps to 2 bps at FNB

- 75% reduction in manual fraud review time at Commerce Bank

Contact us today and stop fraud before losses occur.

3. Operational risk

Operational risk is the risk of loss resulting from inadequate or failed internal processes, systems, human factors, or external events.

It can range from simple human error or software bugs to cyber outages, natural disasters, or fraudulent activity that disrupts banking operations, such as payment processing errors or frozen online accounts.

Events like Hurricane Katrina and major SWIFT payment outages show how large operational failures can cost banks billions in losses, downtime, and recovery efforts.

How to manage it:

- Strengthen internal controls and audits: Implement strong controls, regular reconciliations, and clear separation of duties. Support these measures with ongoing internal audits and self-assessments to identify issues early.

- Business continuity and incident response planning: Keep disaster recovery plans up to date, test backup systems regularly, and run practice drills so staff know what to do during outages or emergencies.

- Real-time monitoring and key indicators: Monitor critical systems in real time, and use automated alerts and dashboards to spot unusual activity or system issues quickly.

- Employee training and redundancy: Cross-train employees and provide ongoing system and process training to reduce errors and avoid single points of failure.

4. Compliance risk

Compliance risk is the risk of legal or regulatory penalties when organizations fail to comply with applicable laws and regulations, such as banking rules, consumer protection statutes, or anti–money laundering requirements.

Some institutions have paid tens of millions for AML lapses, and 89% of community bank executives say regulatory compliance is “extremely or very important.”

How to manage it:

- Integrated governance, risk, and compliance (GRC) tools: Perform regular, enterprise-wide compliance risk assessments. Use GRC tools instead of spreadsheets to better track, analyze, and manage compliance data across teams.

- Ongoing monitoring and updates: Continuously monitor regulatory changes and update policies as needed. Leverage automation and robust documentation to demonstrate management’s understanding and oversight of risk.

- Training and culture of compliance: Provide practical, role-based training tied to daily work. Promote a culture where compliance is seen as part of doing business well, not just meeting requirements.

- Business-unit ownership: Make each business unit responsible for its own compliance controls, with support from a central compliance team.

- Dedicated compliance program: Maintain a strong compliance function with clear roles and accountability. Keep up-to-date policies covering BSA/AML, fair lending, privacy, and other key regulations.

Here is a list of key policies that you need to follow and what they mean:

|

Policies |

What they mean |

|

Bank Secrecy Act (BSA) / anti–money laundering (AML) |

Defines how the organization prevents, detects, and reports money laundering and other financial crimes |

|

Customer identification program (CIP) |

Establishes procedures for verifying customer identities when accounts are opened |

|

Office of Foreign Assets Control (OFAC) sanctions compliance |

Ensures the organization screens and blocks transactions involving sanctioned individuals, entities, or countries |

|

Fair lending |

Requires lending decisions to be made fairly and without discrimination |

|

Consumer compliance |

Governs compliance with consumer protection laws, including disclosures and complaint handling |

|

Data privacy and information security |

Outlines how sensitive customer and employee information is protected and managed |

|

Compliance risk management (CRM) |

Defines how compliance risks are identified, assessed, monitored, and reported across the organization |

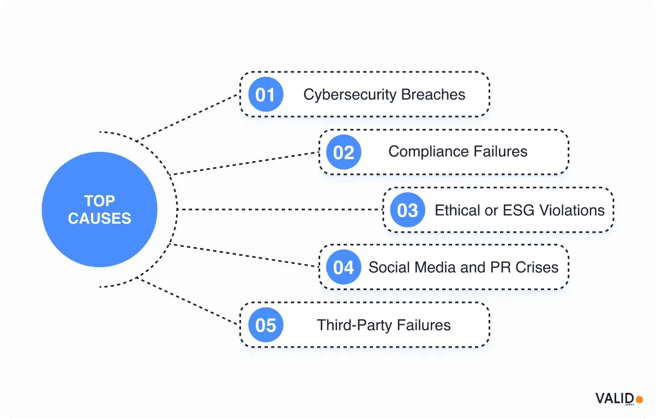

5. Reputational risk

Reputational risk is the chance that a bank may suffer losses if its public image or trust is damaged. Even a single incident, such as a scandal or data breach, can quickly erode customer confidence and lead to lost business or regulatory action.

How to manage it:

- Proactive communication: Respond quickly and honestly when something goes wrong, clearly explaining what happened and how it will be fixed.

- Ethics and culture: Promote a strong, customer-first culture where employees at all levels are encouraged to act ethically.

- Policies and training: Set clear rules and provide regular training so employees understand how their actions affect the bank’s reputation.

- Monitoring public opinion: Pay close attention to customer feedback and social media to catch and resolve problems early.

- Investor and stakeholder engagement: Build strong relationships with investors, regulators, and the community to maintain trust and support during difficult times.

6. Third-party and vendor risk

Third-party and vendor risk arises when banks rely on outside companies for services like technology, payments, or data storage, and those partners experience failures or security breaches.

Because vendor problems can quickly disrupt operations or expose customer data, banks must carefully assess, monitor, and plan for the risks associated with outsourcing.

How to manage it:

- Thorough due diligence: Before hiring a vendor, assess their financial stability, cybersecurity controls, regulatory history, and ability to exit the relationship, as emphasized in the OCC guidance.

- Strong contracts: Include clear service-level agreements (SLAs), data-protection requirements, audit rights, and breach-notification timelines to ensure expectations and accountability are well-defined.

- Ongoing monitoring: Continuously review vendor performance through audits, updated risk assessments, and evidence of controls such as third-party certifications (e.g., SOC 2 or ISO 27001).

- Contingency and exit planning: Prepare backup plans and exit strategies so the bank can continue operating if a vendor relationship ends or fails.

- Managing sub-vendors: Identify fourth parties used by vendors and ensure your security and compliance requirements extend to them as well.

Prevent fraud risk at its source with VALID

Most bank risk controls are designed to observe behavior rather than control it. They record what happened, flag anomalies, and trigger human review. In practice, this is all valuable, but fundamentally passive.

Fraud behaves differently. It moves faster than governance cycles, escalates across channels, and exploits brief windows where controls are observational rather than decisive.

When left unchecked, fraud losses rarely stay contained. They often trigger secondary risks, including reputational damage, customer harm, and regulatory scrutiny tied to compliance and conduct expectations.

This is exactly why you need VALID.

Why leading institutions choose VALID

VALID is an AI-driven risk management and fraud prevention platform that helps financial institutions detect and prevent fraud in real time across digital and check-based transactions.

Processing over $4 trillion in annual check volume across major US financial institutions, VALID provides the visibility needed to stay ahead of rapidly evolving fraud threats.

Here is what VALID can do for you:

- Real-time decisions at the moment of deposit: VALID’s patented Real-Time Loss Alerts (RTLA) and CheckDetect analyze every deposit instantly, whether it’s made via mobile, ATM, or in-branch.

This allows banks to approve, hold, or decline deposits right away, reducing delays, preventing downstream losses, and minimizing unnecessary friction for customers.

- Machine learning that goes beyond the check image: While traditional tools rely mostly on image analysis, VALID assesses risk using a broader, more multidimensional view.

This approach identifies up to 95% of fraud losses while flagging only 0.5% of items, significantly reducing false positives and the need for manual reviews. That broader view includes:

- Behavioral analytics

- Payer–payee relationships

- Transaction context and velocity

- Shared fraud intelligence through Edge: Edge enables financial institutions to tap into shared fraud intelligence across a network of banks. By aggregating transaction data and applying AI, it reveals fraud patterns that are often impossible to detect from a single institution’s perspective.

Key capabilities include:

- Analyzing behavioral patterns across multiple institutions to uncover hidden fraud risks

- Detecting fraud across critical activities such as account opening, funding, lending, and account access

- Strengthening fraud prevention while supporting GLBA compliance

- InstantFUNDS and guaranteed loss coverage: InstantFUNDS delivers sub-second deposit decisions that give customers immediate access to their funds, without increasing fraud risk.

By accelerating approval for up to 99% of deposits and guaranteeing covered losses, InstantFUNDS increases customer satisfaction while enabling financial institutions to grow revenue without added risk.

Contact us today to see how VALID helps you manage non-financial risk and stop fraud in real time.