Did you know that even a single unexpected risk event can disrupt an organization’s operations, finances, or reputation?

Banks and other financial institutions face a wide range of evolving uncertainties, such as cyberattacks and supply-chain failures, that can quickly escalate if not properly addressed. Understanding how to identify, assess, and proactively respond to these risks can be the difference between long-term success and sudden setbacks.

In this article, we will break down what risk management is, how the process works, and which principles every business should follow.

Key takeaways

- Risk management must be continuous and adaptive

Because risks evolve with markets, technology, and regulations, institutions need an ongoing process for identifying, assessing, responding to, and monitoring threats to stay resilient.

- Financial institutions must manage multiple major risk categories

Credit, market, liquidity, operational, compliance, and reputation risks each require dedicated strategies. Understanding these categories helps banks balance their risk exposure and avoid costly surprises.

- Clear risk appetite and strong governance drive effective controls

Leadership must set clear limits, align incentives with safe behavior, and reinforce a culture where every employee understands their role in managing risk.

- The three lines of defense model is crucial for reliable oversight

Front-line teams own day-to-day risks, risk and compliance provide independent guidance and monitoring, and internal audit validates that controls across the organization actually work.

- Real-time analytics are now essential for modern risk management

Traditional tools cannot keep pace with fast-moving fraud and operational threats. VALID’s AI-driven solutions provide real-time scoring, early detection, and even guaranteed loss protection, helping institutions strengthen every layer of their risk framework.

What is risk management?

Risk management is a systematic process for recognizing risks and taking steps to reduce or offset their impact.

In the financial services sector, risk management involves identifying potential threats that could affect earnings or operations, assessing their severity, and taking proactive steps to mitigate or prevent them.

Types of risk financial institutions need to manage

While each organization’s exact risk profile is unique, most banks and credit unions must manage several common categories of risk. Below are the key types of risk and what they mean for financial institutions:

1. Credit risk

Credit risk is the chance that borrowers or business partners won’t repay what they owe, which can lead to major financial losses for lenders.

To manage this, lenders use careful screening, ongoing monitoring, and a balanced mix of loans and investments to help protect themselves during economic downturns or unexpected defaults.

2. Market risk

Market risk is the possibility of losing money when market prices or rates, such as interest rates, currency values, or stock and commodity prices, move in an unfavorable direction.

Institutions limit this risk through techniques like hedging and asset-liability management. This is especially important because rising interest rates can quickly reduce the value of their investments and increase their costs.

3. Liquidity risk

Liquidity risk is the danger that a bank won’t have enough cash to cover withdrawals or other short-term needs, especially if its assets can’t be turned into cash quickly.

To avoid this, banks keep sufficient reserves, use a variety of funding sources, and maintain backup plans to handle sudden spikes in withdrawals or other unexpected cash demands.

4. Operational risk

Operational risk is the risk of losses caused by internal failures, human errors, system outages, or external events such as fraud or cyberattacks.

Strong internal controls, staff training, resilient technology systems, and disaster-recovery plans help reduce this type of risk.

5. Compliance risk

Compliance risk is the chance that a bank could face fines, legal trouble, or reputational damage if it fails to comply with laws and regulations.

To manage this risk, institutions keep their policies current, train employees regularly, monitor for potential violations, and conduct thorough compliance reviews.

6. Reputation risk

Reputation risk is the danger that negative publicity or public opinion will erode trust in a bank, causing customers to withdraw their deposits or stop doing business.

Banks manage this risk by maintaining high ethical and service standards, communicating openly, and responding quickly to any customer issues.

Risk management process

Understanding the types of risks is the first step to managing them successfully, but the management process is not always simple. Here's how it works:

Step 1: Risk identification

The first step is to identify and document risks that could impact the organization’s objectives. This involves reviewing key areas, such as credit, market, liquidity, and operations, to spot potential threats.

A bank, for example, might identify risks like:

- Concentration of loans in a single industry

- Exposure to rising interest rates

- Dependence on one major technology provider

- Increased potential for internal or external fraud

Step 2: Risk assessment

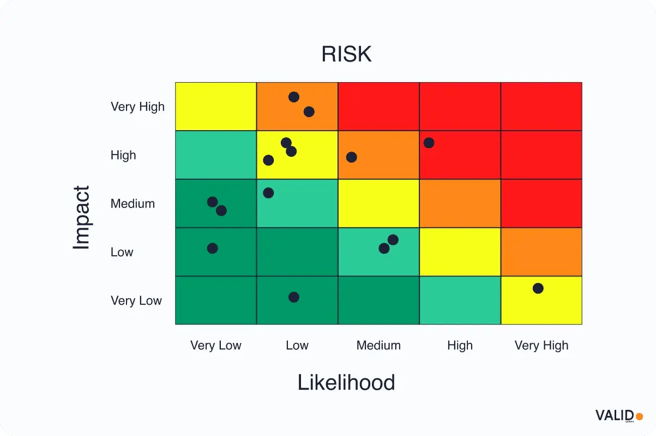

Once the risks are identified, the next step is to evaluate how serious each one is. Not all risks carry the same weight, so organizations assess them based on two key factors: likelihood and impact.

Banks often rely on a mix of qualitative judgment and quantitative analysis. A common method is to estimate the probability of a risk occurring and the financial loss it would cause, then combine these factors (Probability × Impact) to determine severity.

For example:

- A cyberattack: high likelihood, high impact

- A major earthquake affecting one regional branch: low likelihood, high impact

Step 3: Risk response

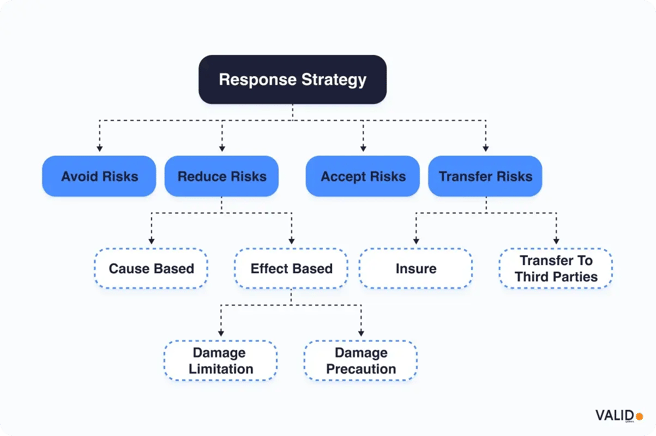

After risks are assessed and prioritized, the organization determines how to address each one. There are four classic response options:

- Avoid the risk: Stop or change the activity that creates the risk.

- Mitigate the risk: Reduce the likelihood or impact through controls or process improvements.

- Transfer the risk: Shift some or all of the risk to a third party (e.g., insurance or vendor contracts).

- Accept the risk: Acknowledge it and take no special action, usually when the risk is minor or within tolerance.

Step 4: Implementation of controls

This step focuses on implementing your chosen risk responses by developing and deploying the appropriate controls or measures.

When the goal is to mitigate a risk, implementation may include:

- Creating new or updated policies

- Revising procedures

- Introducing new systems or tools

When the strategy is to transfer risk, such as through insurance, implementation involves:

- Purchasing the appropriate insurance coverage

- Verifying that the policy limits and terms adequately address the risk

A key part of this phase is assigning clear responsibility so everyone knows who is accountable for each control or action.

Many institutions support this by using risk registers or action plans that document major risks, the controls in place, and the person or team overseeing them.

Step 5: Monitoring

The final step is to continually monitor risks and review whether existing measures are working as intended. This helps ensure the institution’s risk profile hasn’t shifted and that any emerging threats are caught early.

Organizations often track key risk indicators (KRIs) to spot warning signs. For example:

|

Key risk indicator (KRI) |

What it may signal |

Risk type |

|

Increase in past-due loans |

Deteriorating credit quality |

Credit risk |

|

Uptick in phishing attempts |

Higher likelihood of cyber breaches |

Cyber risk |

|

Increase in failed login attempts |

Possible credential attacks or unauthorized access attempts |

Cyber risk |

|

Rise in system downtime |

Technology or vendor performance issues |

Operational/IT risk |

|

Higher transaction error rates |

Process or control breakdowns |

Operational risk |

|

Growth in short-term funding costs |

Liquidity pressure or market stress |

Liquidity/Market risk |

Key principles of effective risk management

For the risk management process to be truly effective, certain basic principles need to be followed. Here are the key principles that successful banks and credit unions use to manage risk:

1. Clear risk appetite and accountability

Good risk management starts at the top. The board and leadership team need to be clear about how much risk the institution is willing to take and where. That clarity sets the tone for everyone else and guides all major decisions.

Key elements include:

- Clear boundaries: Employees should understand the specific limits that guide their work (e.g., maximum loan concentrations, trading limits).

- Aligned performance goals: Risk limits and tolerance levels must tie into how performance is assessed.

- Organization-wide accountability: Every employee should know the company’s approach to risk and recognize their responsibility for operating within the established boundaries.

- Cultural integration: When people at all levels understand and own their role in managing risk, it becomes part of the company culture, not just a compliance exercise.

Example:

Nordea Bank strengthened its governance by creating a clear, board-approved risk appetite that set boundaries for credit, market, and liquidity risk. By aligning these limits with business goals and employee accountability, Nordea significantly reduced uncontrolled risk-taking across the organization.

Their published reports show the impact: risk-weighted assets declined, including a EUR 3.3 billion (approximately USD 3.83 billion) reduction in total risk exposure in Q1 2023, driven by lower equity exposure and stronger credit protection.

2. Multiple lines of defense

An essential principle in financial risk management is establishing multiple layers of defense to identify and address issues before they escalate. The widely used three-lines-of-defense model illustrates how different parts of the organization contribute to effective risk oversight:

- First line (front-line business units): These teams own and manage risk as part of their everyday work. They follow established policies, make informed decisions, and ensure their actions align with the organization’s risk expectations.

- Second line (independent risk management & compliance): This group sets the rules and frameworks for managing risk. They monitor how the first line operates, provide guidance, and step in when activities drift outside the approved risk levels.

- Third line (internal audit): Internal audit offers an independent check on the entire system. They test and validate controls, assess whether policies are being followed, and confirm that both the first and second lines are effectively managing risk.

A strong risk framework uses all three lines in a coordinated way so that if one layer misses an issue, another is positioned to catch it.

Pro tip

Pair your three lines of defense with real-time, high-accuracy decisioning tools. VALID Systems’ solutions give your institution instant insights that help each line of defense act faster, smarter, and with greater precision.

Here’s how VALID can elevate your defenses:

- Enhance the first line: Front-line teams gain sub-second risk intelligence on every check deposit or credit decision, reducing guesswork and improving customer interactions.

- Strengthen the second line: Risk and compliance teams benefit from predictive analytics, behavioral modeling, and portfolio-level insights drawn from billions of data points.

- Empower the third line: With transparent data trails and validated models, audit teams can more effectively test controls and verify alignment with policy.

Contact us today to strengthen your defenses with real-time, AI-driven risk intelligence

3. Comprehensive risk identification and assessment

An institution needs to know what risks it faces and how serious they are. Strong organizations use a structured process to find these risks and judge how likely they are to happen and how much damage they could cause.

Key elements include:

- Structured assessments: Conduct regular risk assessments by reviewing processes, interviewing staff, and analyzing data to spot gaps or weak controls. Workshops and periodic reviews then bring teams together to confirm risks are being managed properly and catch issues before they become losses.

- Scenario analysis: Create realistic “what if” situations, such as a major system outage or a sudden drop in credit quality, to understand how the institution would respond. These exercises help reveal vulnerabilities and guide improvements before a real event occurs.

- Stress testing: Apply severe but plausible conditions, like rapid interest rate changes or liquidity pressures, to financial and operational models. This shows whether the institution has enough capital, liquidity, and capacity to withstand shocks.

- Emerging-risk identification: Monitor trends in technology, regulation, customer behavior, and global events to spot new risks early. Teams use industry research, internal data, and cross-department input to identify threats like AI misuse or climate-related impacts before they grow.

Risk management frameworks and standards to follow

Organizations around the world rely on well-established risk management frameworks to help them identify, assess, and respond to risks effectively. Below are some of the most widely used approaches:

- ISO 31000: Risk Management (Principles and Guidelines): ISO 31000 is a global standard that outlines flexible principles and a general process usable by any organization to manage risk.

- COSO Enterprise Risk Management (ERM): The COSO ERM framework guides organizations in designing, implementing, and monitoring an ERM program that embeds risk management into strategy, performance, and decision-making.

- NIST Risk Management Framework: The NIST RMF provides a structured, repeatable set of guidelines for managing information security and cybersecurity risks, widely used in the U.S. to identify, assess, and mitigate technology-related threats.

- OCEG Red Book: The OCEG Red Book offers guidance for integrating governance, risk management, compliance, and ethics into a unified framework aligned with organizational strategy.

- RIMS Risk Maturity Model (RMM): The RMM helps organizations assess the maturity of their risk management practices by identifying strengths, gaps, and steps for developing more advanced and proactive capabilities.

However, as financial institutions face faster transactions, rising fraud complexity, and growing regulatory pressure, traditional controls alone are no longer enough.

Today’s risks demand real-time intelligence, high-accuracy decisioning, and tools that strengthen every line of defense, from front-line staff to internal audit.

This is exactly what VALID does!

How VALID strengthens the risk management framework

VALID provides AI-driven, real-time risk and fraud solutions that directly support the principles and processes outlined in this guide, helping institutions identify, assess, respond to, and monitor risks with greater speed and precision.

Here are some of VALID’s key capabilities:

- Enhances risk identification: VALID’s behavioral analytics, machine learning, and cross-institution fraud intelligence (through Edge) detect fraud signals that traditional systems miss. This allows institutions to identify threats earlier, whether in check deposits, account opening, account takeover attempts, or payment authorization.

- Improves accuracy in risk assessment: Products like CheckDetect and Inclearing assign precise fraud-severity scores in real time, enabling risk teams to evaluate probability and impact instantly. This minimizes false positives and ensures that staff focus their time on the highest-risk items.

- Enables faster, more effective risk responses: VALID supports all four classic risk responses:

- Avoid: Automatically stop or flag high-risk items before funds move.

- Mitigate: Reduce losses with 95% fraud capture rates and actionable intelligence.

- Transfer: Through Instant Funds, VALID guarantees items approved for instant availability and absorbs the loss if a check later returns.

- Accept: Institutions can confidently accept low-risk items thanks to sub-second ML scoring and historical insights.

- Streamlines implementation of controls: VALID’s solutions integrate seamlessly across channels, ATM, mobile, in-branch, and back-office, making risk controls consistent across the organization. Banks can also customize thresholds to match their risk appetite and regulatory expectations.

Contact us today and discover how VALID can transform your risk management strategy!