Are you considering adding AI to your banking operations but wondering what it looks like in practice?

Today, more than 92% of banks around the world are already using AI in their daily workflows, not as an experiment but as a working solution.

From behind-the-scenes processes to customer-facing services, AI is helping banks work smarter and faster without disrupting the experience people expect.

In this article, you’ll learn five practical benefits of AI in banking and why they’re becoming essential for modern banks.

Key takeaways

- Banks are using AI across their most critical functions

Banks are using AI for fraud detection, customer service, lending, operations, and personalization to move faster, reduce costs, and improve customer satisfaction at scale.

- Fraud detection delivers the biggest and fastest AI ROI

Real-time AI models detect fraud in milliseconds, adapt to new tactics, and dramatically cut false positives, preventing billions in losses compared to rule-based systems.

- AI improves service while lowering operational workload

Chatbots, automation, and employee AI tools handle routine tasks instantly, freeing staff to focus on higher-value work and creating faster, more consistent customer experiences.

- Smarter credit decisions expand access without adding risk

AI underwriting analyzes far more data than traditional models, enabling quicker approvals, more consistent decisions, and higher approval rates with controlled risk.

- VALID turns AI fraud detection into real-time protection

VALID goes beyond alerts by stopping fraud at the point of deposit. It uses behavioral and network intelligence, reduces manual reviews, and covers potential losses so banks can act with confidence.

5 Key benefits of AI in banking

Here is a quick overview of the key benefits of AI in banking:

|

Benefit |

What it does |

Key impact/results |

|

AI-powered fraud detection |

Analyzes transactions in real time, learns normal behavior, flags anomalies, and adapts to new fraud techniques |

Up to 90% faster detection, 40–60% fewer false positives, and billions in fraud losses prevented |

|

24/7 customer service with AI chatbots |

Provides instant answers, completes simple banking tasks, offers financial insights, and escalates complex issues to humans |

Faster service, higher customer satisfaction, reduced call center load (e.g., Bank of America’s Erica with 3B+ interactions) |

|

Smarter loan underwriting & credit decisions |

Uses hundreds of data points, detects complex and non-linear patterns, and continuously learns from loan performance |

Loan decisions in minutes, higher approval rates with controlled risk, and more consistent, objective outcomes |

|

Operational efficiency through automation |

Automates document processing, data entry, workflows, and decisioning while supporting employees with AI tools |

Up to 90% faster processing, fewer errors, lower costs, and significant employee time savings |

|

AI-driven personalization |

Delivers personalized alerts, financial guidance, content, and product recommendations |

Higher engagement, improved loyalty, double-digit gains in revenue and customer satisfaction |

1. AI-powered fraud detection

One of the most practical and widely used applications of AI in banking is fraud detection.

Banks process millions of transactions each day, and detecting suspicious activity in real time requires systems that can operate quickly and accurately across enormous volumes of data.

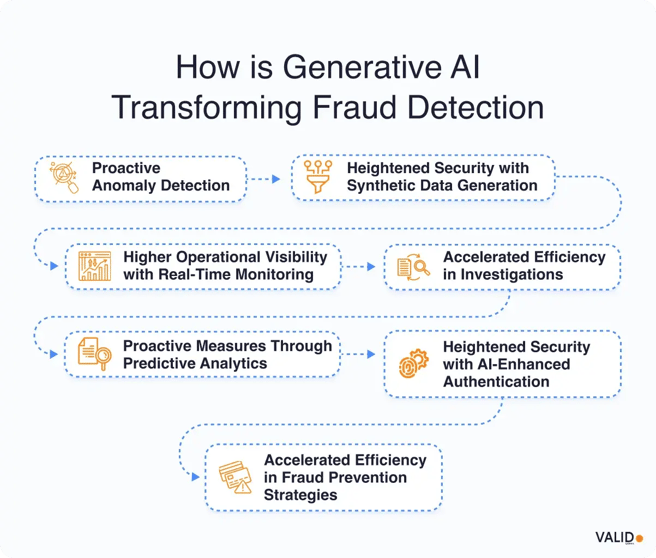

AI-powered fraud detection systems address this challenge by:

- Analyzing transactions in real time at extremely high speeds, allowing potential fraud to be identified as it occurs

- Learning normal customer behavior and spending patterns, creating a reliable baseline for legitimate activity

- Flagging anomalies such as unusual purchases, sudden location changes, or rapid withdrawals that deviate from expected behavior

- Continuously improving by training on historical fraud cases and adapting to new and evolving fraud techniques

A recent industry report found that 91% of U.S. banks now use AI for fraud detection, and banks are already seeing clear benefits from these systems, including:

- Faster detection: Transactions are analyzed in milliseconds, reducing detection time by up to 90% compared to traditional methods.

- Higher catch rates: Advanced neural networks can identify subtle patterns across millions of transactions. In 2023, Visa’s AI systems helped block 80 million fraudulent transactions (worth $40 billion) that could have gone unnoticed otherwise.

- Fewer false positives: By incorporating context and learning from past alerts, AI significantly reduces the number of legitimate transactions flagged. In fact, research shows that AI-powered systems can reduce false positives by around 40–60%.

Pro tip:

Many AI fraud detection systems rely heavily on static rules or narrow data signals, which can lead to missed fraud or excessive false positives. VALID addresses this gap with a validated, real-time fraud decisioning platform that combines behavioral analytics, machine learning, and cross-institution intelligence to adapt as fraud evolves.

What makes VALID a good solution:

- Real-time transaction scoring: VALID evaluates risk at the point of deposit or presentment, stopping fraud before losses occur, not hours or days later.

- Behavioral + transactional intelligence: Machine learning models analyze depositor behavior, payer patterns, velocity, and network relationships, not just check images.

- Continuous model learning: VALID’s ML models adapt as fraud tactics evolve, reducing reliance on static rules and manual tuning.

- Low false positives: Advanced context-aware scoring cuts unnecessary alerts, reducing manual reviews by up to 74%.

- Guaranteed protection: VALID absorbs covered losses on approved items, removing residual risk from your institution.

Contact us today to see how VALID’s AI-powered fraud detection platform can help you stop fraud in real time.

2. 24/7 customer service with AI chatbots

Another highly visible and practical use of AI in banking is customer service through chatbots and virtual assistants. As of 2024, 77% of consumers use some form of AI technology for their banking needs, with virtual assistants playing a major role in everyday interactions.

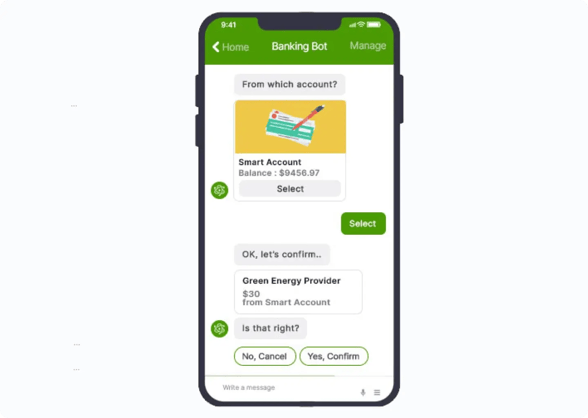

These virtual assistants can:

- Provide instant answers to common questions regarding account balances, recent transactions, and spending summaries

- Perform simple tasks like money transfers, bill payments, and setting account alerts

- Offer basic financial insights, including budgeting tips and spending breakdowns

Importantly, AI chatbots are designed to complement, not replace, human staff. When a request exceeds the chatbot’s capabilities, the system hands the interaction to a customer service representative.

This “high-tech, high-touch” approach allows banks to improve efficiency while maintaining high service quality.

Example: Erica

One of the most successful examples is Bank of America’s virtual assistant, Erica. Launched in 2018 and integrated into the bank’s mobile app, Erica allows customers to ask questions such as “What’s my checking account balance?” or “How much did I spend on groceries this month?” and receive immediate answers.

Erica can also complete tasks like transferring money or paying bills. Since launch, it has handled more than 3 billion customer interactions and has been used by nearly 50 million customers.

The impact on customer experience has been significant:

- Faster service: Customers receive immediate responses instead of waiting on hold.

- Higher satisfaction: Bank of America’s mobile app ranks #1 in customer satisfaction among national banks, with Erica cited as a key contributor.

- Seamless support: Routine questions are handled by AI, while more complex issues are smoothly transferred to live agents.

3. Smarter loan underwriting and credit decisions

Traditionally, underwriting relied on fixed rules and a limited set of data points, such as credit scores, income, and outstanding debt.

AI has transformed this process by enabling more dynamic, comprehensive credit assessments, resulting in faster decisions and better outcomes for both banks and borrowers.

AI-powered underwriting systems improve credit decisions by:

- Analyzing hundreds of data points instead of relying on a small number of fixed criteria

- Identifying complex patterns that indicate creditworthiness and the likelihood of repayment

- Weighing combinations of factors that may offset a lower credit score

- Continuously learning from new loan performance data to improve accuracy over time

- Detecting non-linear relationships that traditional formulas miss, such as spending behaviors or recurring payment patterns

In practice, AI underwriting has changed lending outcomes in the following ways:

- Faster loan approvals: Many AI-powered systems can make decisions in minutes rather than days, improving customer convenience.

- Higher approval rates with controlled risk: By better identifying which applicants are likely to repay their loans, banks can approve more qualified borrowers without taking on additional risk.

- More consistent and objective decisions: Automated models apply the same standards to all applicants, helping reduce human inconsistency and potential bias.

4. Operational efficiency through automation

One of AI’s most significant benefits in banking is operational efficiency. By automating repetitive, manual processes, banks can reduce costs, speed up work, and allow employees to focus on higher-value activities.

Here are several core automation use cases:

- Document processing and data entry: AI uses optical character recognition and natural language processing to read and extract data from forms, IDs, and loan documents. This automation reduces errors and can handle up to 50% of repetitive tasks that once required manual review.

- Workflow automation and decisioning: AI-enhanced robotic process automation accelerates back-office tasks such as transaction processing, reconciliations, and routine approvals. As a result, transactions can be processed up to 90% faster while maintaining accuracy and compliance.

- Employee productivity and decision support: AI tools augment employees by assisting with coding, client preparation, and real-time guidance during customer interactions. At Bank of America, generative AI tools delivered a 20% efficiency gain in software development and saved tens of thousands of employee hours per year by automating routine work.

5. AI-driven personalization

Research shows that 71% of consumers expect personalized banking experiences, while 76% feel frustrated when personalization is lacking, underscoring its critical role in customer satisfaction and loyalty.

These expectations are pushing banks to invest in AI-powered customer insights. A global survey found that 44% of financial institutions are using AI at scale to tailor customer experiences. Those that do report double-digit gains in revenue, customer satisfaction, and campaign conversions.

Here is how it looks in practice:

- Personalized alerts and financial guidance: Many banking apps use AI to flag unusual spending, predict upcoming bills, or suggest savings based on individual habits. These insights help customers feel more informed and in control of their finances.

- Hyper-personalized content and offers: Banks like Wells Fargo use AI to deliver tailored content and product recommendations across digital channels. Each customer sees articles, tips, or offers based on what the AI believes is most relevant to them.

- Higher engagement and loyalty: AI personalization leads to higher digital engagement and stronger customer loyalty. Nearly half of customers are willing to share more data when it results in better, more relevant experiences.

Key challenges of adopting AI in banking

Although AI offers significant advantages for banks, it still has some challenges that make adoption complex and require careful planning and execution.

- Data quality and silos: AI is only as effective as the data that powers it. In many banks, however, data is scattered across legacy systems and stored in inconsistent formats. Without first cleaning, connecting, and modernizing this data, AI initiatives risk stalling or producing underwhelming results.

- Upfront investment and ROI uncertainty: Effective AI solutions demand substantial upfront investment in technology, data infrastructure, and development. The benefits often take time to materialize, which can slow decisions around scaling and long-term commitment.

- Privacy, security, and regulation: Financial data is extremely sensitive, and banks must ensure their AI systems comply with strict privacy, security, and fair-lending regulations. As regulatory scrutiny increases and rules continue to evolve, institutions are under pressure to deploy explainable, well-tested models, which can slow the adoption.

- Ethical and bias considerations: AI systems that produce biased outcomes or lack clear explanations can erode customer trust and invite regulatory action. To mitigate these risks, banks must invest in strong AI governance, ongoing bias monitoring, and transparency to ensure fair, ethical, and accountable decision-making.

Future trends to watch

AI has advanced rapidly in recent years, but this progress is likely only the beginning. Several emerging trends are expected to shape how AI is used across financial services in the years ahead. Below are three key developments to watch out for:

1. Generative AI moving from support to decision-making

So far, banks have mainly used generative AI for support tasks like chatbots, summaries, and internal tools. The next phase is using generative AI in more decision-oriented roles, such as helping shape financial advice, risk reviews, or personalized product recommendations.

Over the next few years, banks will focus on scaling these systems safely so they can be trusted in higher-impact use cases.

2. From personalization to real-time prediction and action

Today’s personalization is mostly reactive, based on past behavior. The future trend is AI that predicts what a customer will need next and takes action in real time, such as preventing overdrafts or offering financing at the exact moment it’s relevant.

Banks that get this right will shift from responding to customer problems to preventing them altogether.

3. AI as a standard tool for every banking role

AI support is currently limited to certain teams or tasks. In the future, nearly every banking role will include AI as a built-in part of daily work, similar to email or spreadsheets today.

This will change how jobs are designed, pushing employees toward higher-level judgment while AI handles analysis, monitoring, and routine decisions.

VALID Systems – The future of fraud detection

As fraud becomes faster, more coordinated, and more sophisticated, banks need more than rule-based alerts and next-day reviews.

The future of fraud detection is real-time decisioning powered by behavioural intelligence, network-wide insights, and models that adapt as threats evolve, without adding friction for customers or workload for teams.

This is exactly what VALID does.

VALID Systems delivers AI-powered, real-time intelligence that helps banks stay ahead of fast-moving check fraud. By combining instant-decisioning, behavioural analytics, and consortium-driven insights, it identifies high-risk items the moment they enter your channels.

VALID partners with major U.S. banks, including PNC, TD Bank, and Truist, and processes over $4 trillion in annual check volume. That scale provides unmatched visibility into emerging fraud patterns and continuously strengthens models as tactics change.

How VALID can help you:

- CheckDetect delivers real-time scoring across mobile, ATM, and branch deposits, identifying high-risk deposits before funds are made available.

- InstantFUNDS provides sub-second deposit decisions with guaranteed funds availability, improving both security and customer experience.

- INclearing Loss Alerts use advanced AI and behavioral analytics to surface suspicious activity that legacy systems routinely miss.

- Edge Fraud Network connects your institution to shared fraud intelligence from leading banks, expanding visibility into evolving threats and emerging scams.

Contact us today to learn how VALID’s AI-powered platform helps you stop fraud earlier, reduce losses, and simplify deposit decisions.