Did you know 63% of respondents reported experiencing attempted or actual check fraud in 2024?

As digital banking expands, criminals are finding new ways to exploit traditional paper checks through theft, forgery, and mobile deposit scams.

For victims, the aftermath can be confusing and stressful, especially when large sums or sensitive information are involved.

In this guide, we’ll walk you through exactly what to do if you become a check fraud victim, from immediate steps to long-term prevention strategies.

Key Takeaways

- Check fraud tactics are becoming more sophisticated

Criminals are now using professional printing tools, chemical “check washing,” and remote deposit scams to steal funds. Businesses are especially at risk because large account balances make fraud harder to detect quickly.

- Immediate action is critical after discovering fraud

If you suspect check fraud, contact your bank immediately to stop payment or freeze accounts, file a police report, and document every detail. Acting quickly can prevent further losses and strengthen recovery efforts.

- Prevention starts with better security and vigilance

Secure your mail, store check stock safely, and use permanent ink to prevent tampering. Encourage staff training and adopt verification tools like Positive Pay to detect mismatched checks early.

- Technology and AI are essential in modern fraud prevention

Advanced AI systems can detect inconsistencies, forged signatures, and duplicate deposits much faster than manual reviews. Leveraging machine learning reduces false alerts and improves customer experience.

- VALID Systems helps institutions stay ahead of fraud

VALID’s AI-driven solutions like CheckDetect and Inclearing identify fraudulent checks in real time, cutting manual reviews by 74% and reducing loss rates by up to 87%. Schedule a demo to see how adaptive fraud prevention can protect your organization and your customers.

What is check fraud?

Check fraud occurs when someone illegally uses or creates checks to steal money or deceive a victim. It involves gaining unauthorized access to funds through paper or digital checks.

For instance, a scammer might reproduce a company check or create a counterfeit one that appears authentic. Government analysts note that business accounts are especially vulnerable because they tend to be well-funded and may not detect fraudulent activity right away.

Types of check fraud

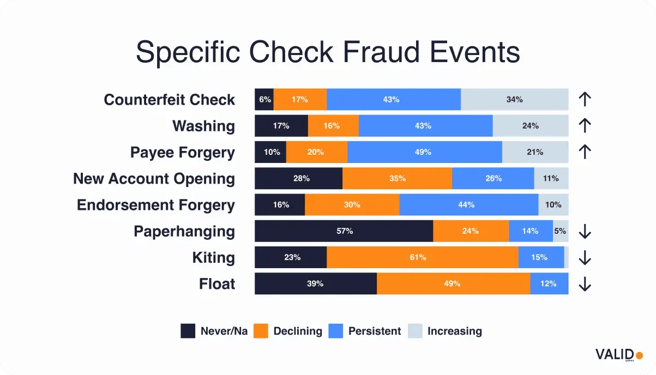

Check fraud can take many different forms, and some schemes are becoming more common than others. The chart below highlights trends in specific types of check fraud events, showing which methods are increasing, persistent, or declining in frequency.

Let’s take a look at the most common types of check fraud in more detail:

1. Counterfeit checks

Criminals use stolen account details and professional printing equipment to create fake checks that look nearly identical to real ones. These counterfeit checks are often drawn on legitimate bank accounts but include forged payee names or altered amounts.

Fraudsters then cash or deposit them before the scam is detected.

Pro Tip

Many altered or counterfeit checks slip through during the clearing process, but modern AI tools can catch them before they cause losses.

VALID’s Inclearing uses machine learning to strengthen fraud detection and streamline clearing operations. Here is what it does:

- Uses AI and behavioral analytics to identify forged or fake checks by spotting inconsistencies, mismatched fields, serial number anomalies, and manipulation that traditional image-based systems often miss.

- Uses ML-powered insights to minimize false alerts, reducing unnecessary holds and improving the customer experience.

- Automates fraud detection to cut manual reviews and accelerate the safe clearing of legitimate checks.

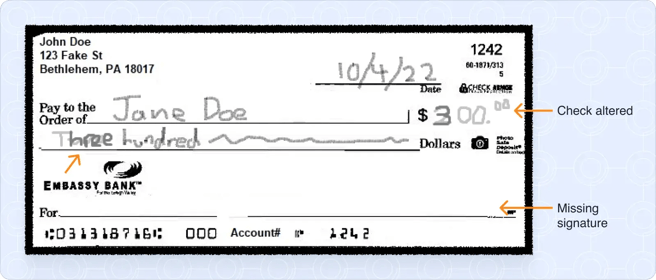

2. Forged or altered checks

In this scheme, a legitimate check is stolen and tampered with. Fraudsters may use chemicals or software to erase and rewrite key details, a process known as check washing. For example, a check written for $100 could be altered to read $1,000 before being deposited.

3. Check kiting

Check kiting exploits the time it takes for checks to clear between different banks. A fraudster writes checks from one account and deposits them into another, using the float time to withdraw funds before the checks bounce. This creates the illusion of available money that doesn’t actually exist.

4. Overpayment and fake invoice scams

Here, a scammer poses as a customer or vendor and sends a check for an amount exceeding the agreed-upon amount. They then request that the “extra” funds be returned. The check eventually bounces, leaving the victim out of the refunded money.

A related version involves fake invoices. Fraudsters send counterfeit checks for nonexistent services or products, tricking victims into transferring funds before realizing the check is invalid.

5. Remote deposit fraud

With the rise of mobile and online banking, scammers have found new ways to exploit remote deposit technology. They persuade victims to deposit fraudulent checks using a mobile app, then withdraw or transfer the funds immediately.

When the check later bounces, the victim is left responsible for the loss. This tactic is common in online sales and business-to-business transactions where the seller is eager to receive payment.

What should you do if you are a victim of check fraud?

Discovering check fraud can be alarming, but quick action is crucial. If you suspect a fraudulent check transaction in your accounts, take the following steps:

1. Contact your bank or treasurer right away

Acting quickly can make a big difference, as your bank may be able to stop payment, freeze funds, and flag the check before more damage occurs.

Ask your bank for copies or images of the questionable check, and write down any key details. Federal guidance is clear on what to do in this case: “Contact your bank immediately and file a police report”.

2. File reports with law enforcement

Report the fraud to your local police department or regional fraud authority as soon as possible. Be sure to include copies of all fraudulent checks, deposit slips, and any related documents.

If you believe mail theft was involved, also contact the U.S. Postal Inspection Service (USPIS) at 1-877-876-2455, which operates a dedicated tip line for mail-related fraud.

For scams or fraud that occurred online, you can also file a report with the FBI’s Internet Crime Complaint Center (IC3).

3. Document everything

Keep a thorough record of all details related to the fraud. Note the dates, check numbers, amounts, and payees involved, as well as any suspicious emails, calls, or messages you received.

Save bank statements from before and after the incident. Comprehensive documentation helps investigators and auditors trace how the fraud occurred and strengthens your case for recovery.

4. Secure your accounts

Work closely with your bank to immediately close or freeze any compromised accounts. Once fraudsters gain access, they often attempt multiple withdrawals or check deposits. Ask your bank to review recent transactions for suspicious patterns or connected accounts that might also be at risk.

If you use online or mobile banking, take these steps to protect your information and prevent further fraud:

- Change your passwords and security questions immediately, using strong, unique credentials.

- Enable multi-factor authentication (MFA) on all banking and financial apps.

- Confirm your contact information (phone number, email, and mailing address) so your bank can alert you to suspicious activity.

- Review authorized users and joint accounts to ensure only trusted individuals have access.

How to avoid check fraud

Knowing what to do if you’re a victim of check fraud is important, but preventing it in the first place is even better. Here are the strategies that can help you significantly reduce your risk of becoming a target:

1. Secure your mail and check stock

Mail theft and stolen check stock are common starting points for check-fraud schemes. Protect your business by handling both securely and minimizing paper check exposure.

How to make it work:

- Retrieve mail promptly and avoid leaving it in the mailbox overnight.

- When sending checks, use secure postal slots or certified mail instead of outdoor drop boxes.

- Store blank checks in a locked safe or cabinet, and track check stock regularly.

- Switch to electronic billing and payments whenever possible to reduce the number of physical checks in circulation.

2. Use strong writing techniques

When writing checks, always use permanent black ink and fill out every field completely. By writing both the numeric and written amounts closely together, you reduce the chance of someone adding extra digits, and you should never leave the payee line blank.

These simple habits make it much harder for anyone to alter or “wash” your checks.

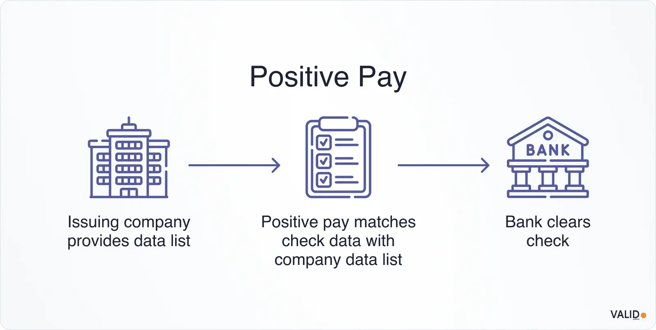

3. Use Positive Pay and verification tools

Many banks offer fraud-detection services, such as Positive Pay, to help protect your accounts. With Positive Pay, you share a list of the checks you’ve issued, and your bank automatically flags any that don’t match.

This method is highly effective, with more than 80% of organizations utilizing Positive Pay to prevent check fraud.

4. Train staff and vendors

Many check-fraud attempts succeed because someone mishandled a request or missed a warning sign. Protect your organization by ensuring that employees and vendors who handle checks, payments, or mail understand the risks and know how to respond to them.

How to do it:

- Train staff to recognize red flags, such as a vendor suddenly requesting a change in payment method or mailing address.

- Always verify changes to vendor payment details through a trusted source, like calling the vendor’s published phone number or a known contact.

- Remind employees to handle checks carefully and report any suspicious or altered items immediately.

- For banks and credit unions, train tellers and customer-facing staff to spot altered or counterfeit checks and to encourage customers to use fraud-prevention tools.

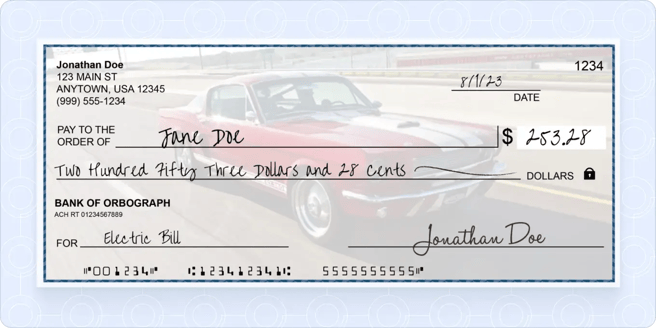

5. Use secure checks and technology

Advanced check design and technology can make it significantly harder for criminals to alter or duplicate checks, and it can help you detect tampering before it results in losses.

Smart ways to stay secure:

- Order checks that include built-in security features such as watermarks, micro-printing, holograms, or UV-sensitive ink, as these are difficult for forgers to reproduce.

- Work with your bank to enable check-scanning or image-analysis software that flags signs of alteration or duplication in real time.

- Use scanners or mobile-deposit systems with integrated fraud filters to detect forgeries or duplicate deposits as soon as checks are presented.

Pro Tip

Advanced tools like VALID’s CheckDetect use AI-driven analysis to identify counterfeit or altered checks the instant they’re deposited, whether through mobile, ATM, or branch channels. This real-time defense prevents over 75% of potential charge-offs before they occur, helping financial institutions stop fraud before it impacts customers.

6. Stay informed about emerging fraud trends

New schemes, such as mobile deposit scams and organized mail-theft rings, emerge almost weekly. Keep an eye on updates from regulators and industry groups such as FinCEN and banking associations.

Their alerts can tip you off to fresh tactics before they hit your network, giving you time to tighten controls and train your teams accordingly.

Pro Tip

Staying protected means using systems that learn as fast as criminals adapt. VALID’s adaptive machine learning models evolve with new fraud patterns, automatically adjusting to emerging threats and reducing reliance on static rules that quickly become outdated.

How can VALID Systems help financial institutions stay ahead of check fraud

As criminals use more sophisticated tools to exploit clearing processes, mobile deposits, and account relationships, financial institutions need defenses that move just as fast. Traditional rule-based systems simply can’t keep pace.

That’s where VALID Systems comes in.

VALID empowers banks and credit unions to detect, predict, and prevent check fraud in real time. Its machine learning platform continuously adapts to emerging fraud patterns, analyzing every transaction through behavioral, payer, and depositor data, catching threats that static systems miss.

The results speak for themselves:

- 87% reduction in loss rates

- 74% fewer manual reviews

- Over $4 trillion in deposits processed annually

How VALID Systems strengthens fraud defense

- Instant, intelligent detection – VALID’s AI-powered decision engine identifies counterfeit, altered, or duplicate checks the moment they’re presented, stopping fraud before losses occur.

- Smarter clearing operations – With Check Inclearing, machine learning scans every transaction for inconsistencies, serial mismatches, or manipulation, reducing manual reviews and ensuring faster, safer clearing.

- Proactive loss prevention – CheckDetect intercepts fraudulent deposits across all channels, including mobile, ATM, and branch, preventing up to 75% of potential charge-offs before they occur.

- Frictionless customer experience – InstantFUNDS provides customers with immediate access to legitimate deposits while keeping your institution fully protected, eliminating unnecessary holds and delays.

- Shared industry intelligence – Through the Edge Data Consortium, VALID connects institutions in a secure network that identifies emerging fraud patterns earlier than any single bank could alone.

Schedule a demo today and see how top institutions use adaptive AI to detect, prevent, and outpace check fraud in every form.