Did you know that 63% of organisations reported being exposed to check-fraud attempts in 2024, making it the payment method most often targeted by fraudsters?

For banks, this trend is especially concerning because it impacts not only loss numbers but also client trust, regulatory risk, and operational burden.

However, with the right strategies and tools, financial institutions can turn this challenge into a strength by spotting red flags early and embedding robust defences.

In this article, you’ll learn how to spot and prevent cashier’s check fraud, as well as implement practical processes that reduce exposure across your operations.

Key takeaways

- Cashier’s checks can be counterfeited and exploited

Counterfeit cashier’s checks look highly authentic and take advantage of the banking rule that releases funds before a check fully clears. This creates a window where victims unknowingly send out real money on fake checks.

- Classic scam patterns repeat across industries

Overpayments, fake job offers, mystery shopper assignments, lottery winnings, and urgent refund requests are the most common schemes. Any situation where someone sends a large check and asks for money back should be treated as high-risk.

- Red flags help banks and customers stop fraud early

Warning signs include unusual overpayments, blank or mismatched check details, poor security features, rushed timelines, unexpected mail origins, or customers immediately wiring out funds after deposit.

- Advanced analytics and imaging dramatically improve detection

Tools like behavioral modeling, check image analysis, Positive Pay, and consortium data sharing catch anomalies faster than manual review. They help flag unusual depositor behavior, duplicate checks, and altered images in real time.

- VALID Systems provides powerful real-time defense for modern institutions

VALID’s CheckDetect, InstantFUNDS, and consortium-driven intelligence give banks the ability to score deposits instantly, spot high-risk items the moment they enter any channel, and clear legitimate checks faster while significantly reducing fraud losses.

What is cashier’s check fraud?

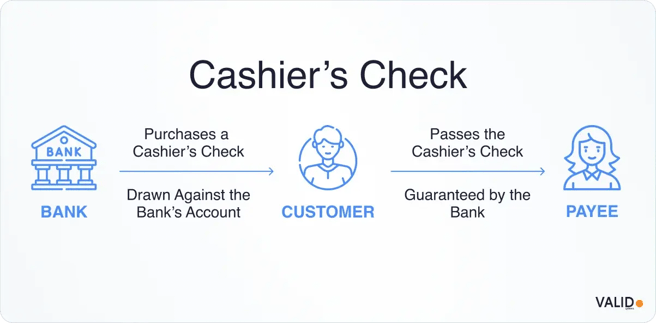

A cashier’s check is a check issued and guaranteed by a bank or credit union. When a customer buys a cashier’s check, the bank immediately withdraws funds from the customer’s account and assumes payment responsibility.

This “guarantee” makes cashier’s checks attractive for large transactions (such as real estate closings) since they should not bounce when deposited.

Scammers, however, exploit that trust by producing counterfeit cashier’s checks. A typical scheme involves sending a seemingly guaranteed check for a large amount, having it deposited, and then requesting that a portion be returned (for instance, as a refund or commission).

Common cashier’s check scams

Fraudsters frequently employ recurring check-based scam patterns. Common examples include:

- Overpayment scams – The fraudster poses as a buyer and sends a counterfeit cashier’s check exceeding the purchase amount, requesting the “excess” be refunded.

- Job or mystery-shopper scams – A bogus employer or recruiter issues a fake cashier’s check, instructing the victim to deposit it and forward part of the funds to third parties.

- Lottery or inheritance scams – Victims are told they have won a foreign lottery or inherited funds. A counterfeit check is provided to cover “taxes” or “processing fees,” which must be paid upfront.

In all cases, the victim deposits the fraudulent check, often via ATM or mobile deposit, to avoid scrutiny, then disburses funds before the item is returned unpaid and the fraud is identified.

Why the scam works

Scammers exploit U.S. banking rules that require banks to make funds from cashier’s or certified checks available by the next business day (Regulation CC, also known as the Expedited Funds Availability Act).

This creates a dangerous window where victims can access and spend the money before the bank confirms the check’s authenticity.

Banks and fintechs can reduce that risk by using an exception hold under Reg CC when there’s “reasonable cause” to doubt a check’s legitimacy. If a check shows any red flags, such as mismatched names, suspicious overpayments, or unusual instructions, institutions should delay releasing the funds until verification is complete.

Key red flags and warning signs

Some common warning signs of counterfeit cashier’s checks include:

- Unsolicited or unusual requests – Requests to deposit a cashier’s check and immediately send money back for “fees,” “refunds,” or “purchases” are classic scam tactics. Any insistence on a fast turnaround or vague explanations for why funds must be returned should be treated as highly suspicious.

- Overpayments or large amounts – Checks that greatly exceed the expected amount, such as an overpayment for rent, an item, or a service, are frequently used to create a refund scam. Legitimate payers rarely issue overpayments before product delivery or verification.

- Blank or inconsistent details – Counterfeit checks often display missing, mismatched, or inconsistent information, such as blank payee lines, postmarks from a different city than the issuing bank, or amounts and payee names that do not match the original agreement. Even small inconsistencies may indicate a fake.

- Poor security features – Authentic cashier’s checks contain security elements such as watermarks, color-shifting ink, and security threads. Checks with missing, blurry, misaligned, or low-quality security features should be assumed suspicious until verified.

- Pressure or urgency – Fraudsters commonly create artificial urgency with statements like “The deal will be lost if funds are not sent immediately.”, to prevent verification. Requests framed with a short deadline or strong pressure to act quickly are a major red flag for both customers and bank staff.

|

Red Flag |

Recommended Action |

|

The customer deposits a check, then immediately wires or funds out, or buys gift cards. |

Hold transaction — Use an exception hold and call the customer to confirm legitimacy. |

|

The check payee line is blank or contains mismatched information. |

Investigate — Inspect the check for security features and call the issuing bank using a verified number. |

|

The check amount exceeds the agreed price, and a refund is requested. |

Educate and hold — Inform the customer that this is a common scam, hold the funds, and consult the fraud department. |

|

Multiple cashier’s checks are deposited in quick succession to the same or related accounts. |

Report for review — This may indicate potential money mule activity. File a Suspicious Activity Report (SAR) if necessary. |

|

A check is issued from mail with an unusual postmark or from a foreign area. |

Verify — Cross-check postal information, contact the U.S. Postal Inspection Service, and hold the item if needed. |

Strengthen cashier’s check fraud detection with technology and data

Effective fraud defense combines traditional controls with advanced, data-driven techniques. Some key detection techniques and their primary benefits include:

|

Detection Technique |

Purpose/Benefit |

|

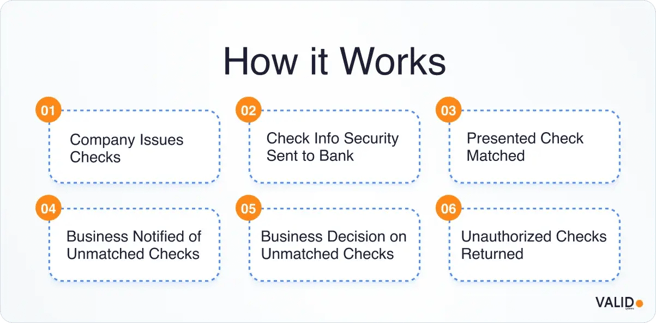

Positive Pay/Reverse Pay |

Prevents the payment of unauthorized checks by matching against the issuance file |

|

Duplicate & Payee Verification |

Automates check sorting to spot duplicate check numbers or altered payees (third-party payee check verification) |

|

AI/ML Models |

Detect anomalies in check deposit behavior (velocity, location, amount, frequency) beyond simple rules |

|

Check Imaging Analysis |

Scans check images for subtle signs of tampering; compares logos/inks to known samples |

|

Blocklisting & Hot Lists |

Blacklist known fraudulent account numbers or serials (e.g. from law enforcement) |

|

Consortium Data Sharing (e.g. 314(b)) |

Share check fraud incidents and stolen check IDs with other institutions in real time. Enables cross-bank alerts |

|

Account Monitoring |

Watch for high-risk patterns: new accounts receiving large checks, multiple accounts receiving small checks (muling) |

|

Intelligence Feeds |

Use fraud intelligence (like lists of compromised accounts or known fraud typologies from police reports) to flag entries |

Advanced analytics, imaging, and behavioral intelligence can enhance these methods, enabling faster, more accurate fraud detection. Here’s how:

1. Use pattern recognition and behavioral analytics

Leverage data analytics and machine learning to understand how customers normally use checks and detect when something doesn’t fit, such as typing geography, timing, and payer-payee relationship.

Any sudden deviations from that normal behavior, like sudden large deposits from an account that rarely uses checks or a spike in round-dollar amounts, can signal fraud. In this case, the system would flag the transaction in real time, allowing banks to review it before any funds are lost.

Solutions like Valid’s CheckDetect help you track and interpret these anomalies in real time. Valid uses advanced analytics to learn normal depositor behavior, identify irregularities, and predict check fraud before it occurs.

Its real-time fraud decisioning engine combines payer data, depositor activity, and transaction context to establish a behavioral baseline for each customer.

For instance, when a transaction deviates sharply from an account’s usual behavior, such as an unexpectedly large or irregular check deposit, CheckDetect’s AI scoring model immediately elevates the risk level and flags it for review.

2. Enhance check imaging and MICR analysis

AI-driven image analysis can detect subtle anomalies in check images, from mismatched fonts or logos to missing watermarks. These tools can:

- Compare a deposited check’s visual and MICR (Magnetic Ink Character Recognition) data against verified genuine samples.

- Elevate image, transaction, MICR, and counterparty analysis through machine learning, as highlighted by Verafin.

- Leverage consortium-based imaging networks to compare suspicious check images across institutions, uncovering duplicate or forged checks faster.

Pro Tip

With VALID Systems, financial institutions can elevate check-fraud defenses through AI-powered analysis of check imagery and MICR/line-item data. VALID’s CheckDetect engine assesses each deposit in real-time, while the Edge Data Consortium enables cross-institutional sharing of fraud signals, allowing for earlier detection of duplicates, forgeries, or altered checks, thereby reducing manual review and enhancing the customer experience.

3. Positive Pay and account reconciliation

Positive Pay is a long-standing control in which the issuer of checks provides the bank with a list of issued checks, including check numbers, payees, and amounts. The bank then “pays on promise,” meaning it only honors checks that exactly match the provided list.

Many banks now bundle this service with ACH Positive Pay, extending the same verification concept to electronic payments. Although Positive Pay is more common for business accounts, banks should encourage all commercial customers to adopt it as a standard fraud-prevention measure.

Operational & internal controls

Strong internal policies, oversight, and well-defined workflows are critical to preventing check fraud and maintaining compliance.

1. Strengthen issuing controls

If your institution still issues cashier’s checks, you should enforce tight procedures:

- Dual authorization: Require two employees (or one plus a manager) to approve large cashier’s checks or wire transfers.

- Customer verification: Confirm customer identity using reliable documentation (e.g., driver’s license, signature on file) and ensure that KYC/CIP information is up to date.

- Audit trail: Maintain a detailed issuance log (check number, date, amount, payee, issuing teller, and customer signature) and review unclaimed checks periodically.

- Remote issuance limits: Avoid issuing checks to remotely opened accounts unless robust authentication is in place.

2. Apply effective deposit controls

For checks deposited at your institution, you should:

- Require teller ID checks and signature comparison, with dual review for large deposits.

- Apply Regulation CC exception holds whenever there is uncertainty about a check’s legitimacy, as permitted by OCC guidance.

- Ensure communication between the branch, ATM, and digital channels to quickly flag and verify suspicious deposits.

3. Improve customer and account monitoring

Fraud prevention should align with Anti–Money Laundering (AML) protocols:

- Enforce rigorous CIP/KYC processes during account opening.

- Flag abnormal activity such as multiple small accounts, high check volumes, or frequent cashier’s check deposits.

- Conduct enhanced due diligence for cash- or check-intensive businesses.

4. Train staff to detect scams

Even the best systems rely on vigilant employees. Robust training and clear response procedures significantly strengthen fraud defense.

Details your staff should be familiar with include:

- Red flags & reporting: Train tellers, branch managers, and digital operations staff to recognize classic cashier’s check scam patterns. Maintain a “fraud playbook” with examples, and ensure staff know exactly whom to notify when a potential scam is detected.

- Use of exception holds: Employees must understand that “no loss yet” is not acceptable reasoning when suspicion exists. If fraud is suspected, apply the Reg CC exception hold, as Federal Reserve guidance explicitly permits depositary banks to extend holds for “reasonable cause.”

- Internal escalation procedures: Create a rapid-review process for high-risk deposits. A fraud analyst should verify the check’s legitimacy and, if necessary, reach out to the customer, place a SAR flag, or involve law enforcement.

- Record retention: For every suspicious check, retain all relevant materials, check images, communications, custody chain, and related SARs, for future analysis or regulatory requests.

- Regular drills and updates: Conduct periodic “fraud drills” similar to cybersecurity exercises. Simulate check-fraud incidents, review team responses, and update training materials as new scam patterns emerge (per OCC fraud risk bulletins).

5. Educate customers and partners

Compliance controls are only effective when paired with strong public awareness and outreach. You can significantly reduce check fraud losses by proactively educating your customers and partners. This includes:

- Public awareness campaigns: Collaborate with regulators and industry groups to share the latest information on scams. Distribute USPIS or FDIC brochures, and post short tip sheets online.

- Website alerts & emails: Use digital channels to warn customers about common scams, such as overpayment or mystery shopper checks. Remind them that even “guaranteed” cashier’s checks can be counterfeit.

- Direct outreach to high-risk customers: Identify and target vulnerable groups, such as seniors, small business owners, and real estate clients, with customized fraud warnings. Advise them to verify large or advanced cashier’s checks before releasing goods or funds.

- Partner with consumer agencies: Work with agencies like the FTC, USPIS, and local law enforcement to share fraud alerts and reporting resources. Ensure internal complaint or fraud reporting portals feed directly into SAR or fraud review processes.

Real-world examples of cashier’s check fraud

Here are two recent examples of cashier’s check fraud:

1. The Borthwick cashier’s check scheme (2025)

In 2025, Gabrielle Borthwick of New York was charged with a multi-state cashier’s check fraud scheme. She used stolen personal information to create counterfeit cashier’s checks worth about $2.7 million, depositing them in banks across Missouri and Illinois.

Although most were flagged, she successfully withdrew over $270,000 before being caught. The case highlighted how authentic-looking fake cashier’s checks can quickly exploit gaps in bank verification systems.

2. The Midwest vehicle-sale fraud ring (2023–2025)

From 2023 to 2025, a St. Louis-based group ran a $1.7 million cashier’s check scam targeting private car sellers.

Using fake cashier’s checks printed with real bank logos, they “bought” vehicles, resold them for cash, and vanished before banks uncovered the fraud. Several members were convicted, including one sentenced to over 12 years in prison.

Strengthen your check fraud defense with VALID Systems

VALID Systems delivers the real-time intelligence modern institutions need to stay ahead of fast-moving check fraud. The platform combines instant deposit decisioning, behavioral analytics, and consortium-driven insights to identify high-risk items the moment they enter your channels.

VALID partners with major U.S. banks, including PNC, TD Bank, and Truist, and processes over $4 trillion in annual check volume. That scale provides unmatched insight into emerging fraud trends and fuels adaptive models that evolve as tactics change.

How VALID can help you:

- CheckDetect delivers real-time scoring across mobile, ATM, and branch deposits, identifying high-risk deposits before funds are made available.

- InstantFUNDS provides sub-second deposit decisions with guaranteed funds availability, improving both security and customer experience.

- INclearing Loss Alerts use advanced AI and behavioral analytics to surface suspicious activity that legacy systems routinely miss.

- Edge Fraud Network connects your institution to shared fraud intelligence from leading banks, expanding visibility into evolving threats and emerging scams.

Schedule a consultation today to see how VALID can strengthen your defenses, speed up decisions, and reduce fraud-related losses.