Check washing fraud is rapidly evolving, and scammers are becoming more skilled at manipulating checks to steal money before anyone notices.

Today’s criminals use a mix of chemical washes, stolen mail, and digital tools to alter checks with alarming accuracy.

The good news is that there are reliable strategies to identify red flags early and prevent fraudulent checks from becoming costly losses.

In this article, we’ll break down what check washing fraud is, how scammers carry it out, and what practical steps you can take to protect yourself.

What is check washing fraud?

Check washing fraud occurs when a scammer steals a legitimate check and uses chemicals to erase the handwritten details, typically everything except the signature. They then rewrite the check, changing the payee’s name and often increasing the amount.

Once altered, the check is deposited or cashed, allowing the thief to pull money from the victim's account before they even know something is wrong.

This type of fraud is rapidly increasing, and the data reveal just how serious the problem has become. Here are the latest statistics:

- Banks filed over 665,000 suspicious activity reports related to check fraud in 2023, a 134% increase compared to 2020.

- A federal survey found that check fraud now accounts for approximately 30% of all fraud losses, second only to debit card fraud.

- In just one six-month period of 2023, Americans lost more than $688 million to mail-theft-related check fraud.

How do scammers wash checks?

Check washing fraud doesn’t happen overnight. It’s a process that typically requires a few steps:

Step 1: Stealing the checks

Scammers can’t alter a check until they steal one, and mail theft is their favorite tactic. They often target residential mailboxes, especially those with the flag up as it signals that outgoing payments may be inside.

Criminals also break into USPS blue collection boxes, hit postal facilities or mail trucks, and, in more serious cases, even rob postal workers.

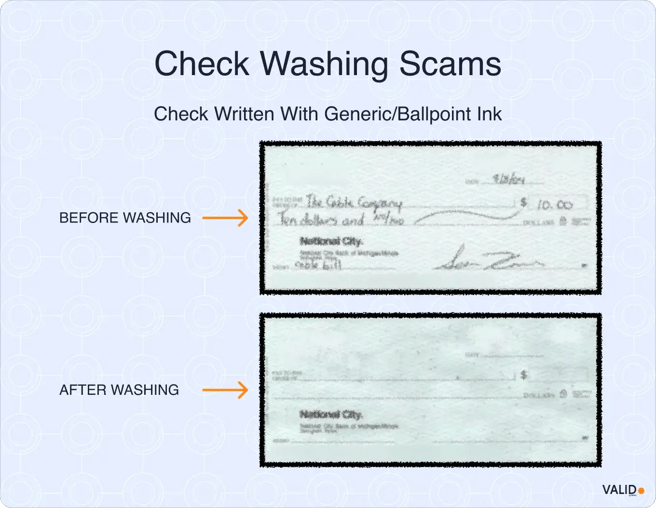

Step 2: “Washing” the Ink

Once they have a stolen check in hand, scammers use a technique called check washing to erase the handwritten payee and dollar amount, allowing them to rewrite the check for their own benefit.

They usually preserve the authentic signature, often by covering it with tape, while using readily available solvents or household chemicals to break down common inks, leaving the check looking legitimately “blank.”

Some fraudsters now skip chemical washing altogether by digitally scanning a check, editing the details, and printing a highly convincing counterfeit.

Step 3: Rewriting and cashing the check

After removing the original ink and drying the check, scammers rewrite the payee and amount, typically using permanent ink that cannot be easily altered again.

They may make the check payable to themselves, a cooperating “mule,” or a fabricated identity backed by a fake ID. They also tend to inflate the amount, turning an ordinary $100 payment into something like $1,000 by simply adding a zero.

How do scammers cash or deposit a washed check?

With the check now tailored to their chosen name and inflated value, the scammer may:

- Deposit the check through ATMs or mobile banking apps using accounts they control, often opened with stolen or synthetic identities.

- Use mobile deposit to avoid tellers, making it easier to slip fraudulent checks through.

- Cash the check in person at a bank branch or check-cashing store using a fake ID that matches the rewritten payee name.

- Rely on money mules, who use their legitimate bank accounts to deposit the fraudulent check and withdraw the cash for a cut.

- Sell washed checks on the black market, where other criminals buy and complete the fraud.

What happens if a bank accepts a washed check?

When a washed check slips through the system, it often appears legitimate at first, so the bank credits the scammer and pulls money from the victim’s account during normal processing.

By the time the fraud is discovered, the thief has usually withdrawn or transferred the funds, leaving little hope of recovering the funds.

In the end, the victim’s balance is depleted, the scammer disappears with the cash, and the bank is left to sort out the fallout.

Who bears the loss?

In most cases, banks, not consumers, absorb the loss, but the outcome can depend on timing and specific circumstances.

Key points:

- Under U.S. banking rules, if a check is altered or forged, the bank that first accepted it is generally liable for the loss and must reimburse the drawee bank or customer.

- Consumers are typically not responsible for fraudulent withdrawals as long as they report the issue promptly.

- Delayed reporting (such as failing to review statements for months) can reduce or eliminate the bank’s legal responsibility to reimburse.

- Most jurisdictions place the burden on banks to detect altered checks, and many banks refund victims even when not strictly required, both to protect customers and to avoid reputational damage.

Impacts on banks

When a bank accepts a washed check, the consequences can ripple throughout the organization and affect its operations, security efforts, and customer relationships. Aside from the direct financial loss, banks must also manage:

- Operational strain – Staff must dedicate significant time to reviewing transactions, gathering documentation, filing fraud reports, and working with law enforcement, which pulls resources away from everyday banking tasks.

- Higher prevention and compliance costs – Banks need to continually invest in upgraded fraud-detection technology, machine-learning tools, stronger internal controls, and ongoing employee training to keep up with evolving check-washing tactics.

- Reputational damage – Customers may start questioning the bank’s security practices, lose confidence in the safety of their accounts, and, in some cases, move their business to another institution.

5 strategies to protect from check washing fraud

Banks and credit unions can significantly reduce exposure to check washing fraud by taking proactive measures. Below are several key strategies and safeguards to help prevent these schemes:

1. Establish clear policies, controls, and risk-based hold procedures

When expectations are clearly defined and consistently applied, from frontline staff all the way through back-office operations, fewer gaps are left for criminals to exploit.

Key practices banks should implement:

- A comprehensive, written check-handling and exception-management policy that outlines step-by-step procedures and provides clear escalation paths for unusual or suspicious situations.

- Risk-based Reg CC hold guidelines tailored for new accounts, high-value deposits, and transactions that deviate from a customer’s normal activity patterns.

- Supervisor review and approval requirements for deposits considered large, atypical, or inherently high-risk to ensure an added layer of oversight.

- Segregation of duties across acceptance, review, and posting functions to reduce the likelihood of errors or internal manipulation and ensure independent checks at each stage.

- Annual policy reviews, plus mandatory revisions following any significant fraud incident, to keep procedures aligned with evolving threats and regulatory expectations.

2. Invest in continuous staff training and fraud awareness

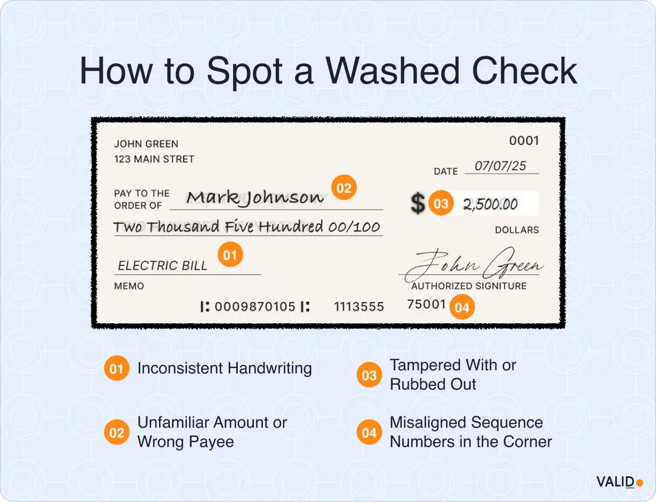

Well-trained employees play a critical role in identifying the physical, behavioral, and situational red flags that signal potential check fraud. Consistent, practical training ensures staff can spot issues like washed or altered checks early and take the right steps to prevent losses.

Key components of effective training programs:

- Hands-on instruction for inspecting physical checks, such as spotting altered handwriting, ink inconsistencies, chemical wash marks, or lifted fibers.

- Guidance on recognizing suspicious depositor behavior, including rushing to cash out, presenting mismatched identification, or showing signatures that don’t align with past patterns.

- Scenario-based drills for high-pressure situations like customers demanding immediate funds, trying to avoid holds, or pushing for exceptions.

- Clear triage and escalation playbooks so employees know exactly who to involve and how to respond when something appears to be off.

3. Deploy real-time deposit analytics across all channels

Traditional batch reviews and manual checks aren’t fast enough to keep up with today’s fraud attempts. Real-time monitoring allows the bank to identify high-risk deposits the moment they’re submitted, reducing losses before funds move.

Core elements of an effective real-time analytics program:

- Instant risk scoring on every check deposit across mobile, ATM, branch, and ITM channels to ensure consistent scrutiny everywhere.

- Automated alerts and hold triggers that escalate or delay the release of funds when deposits exceed predefined risk thresholds.

- Flagging for anomalies in payee details, check stock, MICR lines, image quality, or deposit patterns that often indicate tampering or manipulation.

- Centralized, institution-wide visibility so all channels operate with the same information and none become blind spots.

- Routine updates to detection rules and models informed by recent fraud cases and emerging patterns.

Pro tip

VALID Systems specializes in real-time check-fraud screening. Its CheckDetect module reviews check deposits across mobile, ATM, and in-branch channels all at once. Using AI, it flags suspicious items the moment they’re submitted, giving your team the chance to stop altered or stolen checks before they clear.

Banks that use tools like this have been able to identify more than 75% of potential check-deposit fraud up front, dramatically cutting down on unexpected losses.

4. Implement advanced verification tools (Positive Pay + AI Imaging)

Strong verification tools help confirm a check’s authenticity before any funds are released. These safeguards reduce the chance of altered, duplicated, or counterfeit items slipping through.

Key components of a strong verification framework:

- Positive Pay and Payee Positive Pay for all commercial clients to match issued-check data against items presented for payment.

- Duplicate check detection to identify the same check being deposited across multiple banks or channels.

- AI-based image forensics capable of spotting:

- altered or substituted payee names

- ink patterns consistent with chemical washing

- counterfeit or mismatched check stock

- signatures that deviate from known samples

- On-us check verification integrated with internal records, including signature files, check-number histories, and account-specific parameters.

Pro tip

VALID’s CheckDetect delivers industry-leading counterfeit detection by analyzing inconsistencies across check fields, identifying mismatched templates, and flagging MICR or serial number anomalies in real-time.

Its AI-driven image forensics can spot subtle signs of forgery or alteration that manual review rarely catches, helping institutions stop counterfeit checks before they ever enter the clearing process.

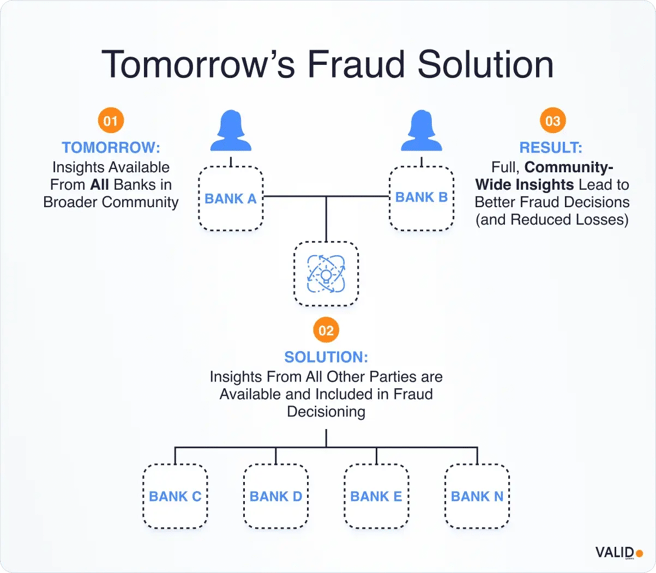

5. Use cross-bank data sharing to stay ahead of fraud

Organized groups rarely target just one institution, often striking multiple banks in coordinated waves. Sharing timely intelligence helps institutions identify emerging patterns sooner and stop criminals before losses spread.

How to put this into practice:

- Participate in 314(b) information sharing to exchange relevant fraud-related details with other institutions under a protected framework.

- Use industry consortium and ABA databases to access real-time alerts on active fraud patterns, repeat offenders, and circulating check templates.

- Contribute your own confirmed cases to strengthen collective intelligence and help other institutions stay ahead of threats.

- Join regional fraud working groups to monitor local trends such as mail theft hotspots, mule activity, and coordinated deposit schemes.

Pro tip

VALID’s Edge Data Consortium gives institutions a powerful advantage by enabling secure, AI-driven data sharing across banks and credit unions.

By pooling intelligence on fraudulent items, behaviors, and emerging patterns, Edge identifies coordinated fraud activity far earlier than any single institution could on its own, helping stop counterfeit checks, account-opening scams, and deposit schemes before they escalate.

Real-world examples of check washing fraud

To understand the serious financial and personal consequences of check washing fraud, consider several recent real-world cases.

1. New York “check washing” ring

A New York check-washing ring operated from early 2022 through mid-2024, stealing mail and altering checks, a scheme that caused millions in losses, including about $176,000 taken in a single 2023 theft.

The group was led by Michael Edwards and included Shakeemo Hill, William Hill, Alixandria Lauture, Shuron Malone, and Carlos Mercado.

They used stolen postal keys to pull mail from collection boxes and then chemically or digitally rewrote the checks.

2. Inside job with postal arrow keys

In 2023, a former Florida mail carrier was caught trying to sell stolen USPS arrow keys along with nearly $550,000 in stolen checks.

Arrow keys open secure mail collection boxes and cluster mailboxes, giving thieves access to large volumes of mail.

By offering both the keys and the stolen checks, he directly supplied the tools needed for large-scale check-washing activity. He was arrested after attempting to sell them to an undercover agent.

3. COVID-19 Relief Fund scheme

Six people were charged during the pandemic with attempting to steal $80 million by cashing fraudulent checks tied to COVID-19 relief funds.

Some of these checks were believed to have been obtained from government mailings and then altered or washed before being deposited.

The group inserted large volumes of fraudulent checks into the relief system to exploit the urgency and scale of federal aid programs.

Prevent check washing fraud with VALID Systems

VALID Systems delivers next-generation fraud prevention powered by machine learning, cross-bank intelligence, and real-time transaction scoring.

By processing over $4 trillion in annual check volume across major U.S. institutions, VALID provides the advanced visibility and predictive analytics required to stay ahead of rapidly evolving fraud threats.

How VALID can help you:

- CheckDetect delivers real-time scoring for every deposit, across mobile, ATM, and branch channels, intervening before fraudulent checks are released.

- InstantFUNDS offers sub-second deposit decisioning and guaranteed funds availability, all without increasing risk.

- InteliFUNDS clears 99% of legitimate deposits instantly while isolating the small percentage that warrants deeper review.

- INclearing Loss Alerts apply advanced AI and behavioral analytics to detect suspicious activity that legacy systems often miss.

- Consortium Edge connects your institution to shared fraud intelligence from top U.S. banks, expanding your protection against new and coordinated attacks.

Schedule a consultation to see how VALID can reduce check fraud losses, streamline reviews, and deliver a safer, faster experience for your customers.