Check fraud detection. Built for modern banks.

Traditional counterfeit check detection often relies on outdated image analysis and rule-based filters. VALID uses real-time machine learning to scan for inconsistencies, serial number mismatches, MICR anomalies, and issuing bank templates to stop fraud at the source.

Why choose VALID for check fraud detection?

See why leading financial institutions trust VALID to stop forged checks before they impact customers or cause losses.

Precise real-time fraud prevention

VALID’s CheckDetect engine helps you detect counterfeit checks with unmatched accuracy, using a combination of bank-specific templates and behavioral analytics scanning for:

-

Inconsistent check serial sequences

-

MICR line discrepancies and anomalies

-

Invalid issuing bank patterns

-

Cross-channel fraud signals from ATM, mobile, and branch

By analyzing every presentment in real time, VALID eliminates false positives while capturing over 95% of actual fraud attempts.

Multi-layer verification to stop sophisticated forgeries

VALID goes beyond surface-level checks. Our systems ingest and score hundreds of fraud signals per item, splitting anomalies across check data, payer-payee behavior, account patterns, and previous fraud indicators.

-

Severity scoring to triage fraud reviews

-

Behavioral models

-

Machine learning models custom-tailored to the bank's needs

-

Automated flagging across deposit channels

With real-time decision-making, you can act instantly, reducing loss, avoiding manual reviews, and eliminating unnecessary holds.

Embedded into your core systems

VALID integrates directly with your existing deposit workflows, whether at the ATM, mobile app, or teller line. Our channel-agnostic architecture enables universal protection, while our fraud scoring and alerting plug into existing review queues.

-

Channel-agnostic decisioning: ATM, mobile, branch

-

Configurable thresholds and fraud rules

-

Easy integration with your core banking systems

-

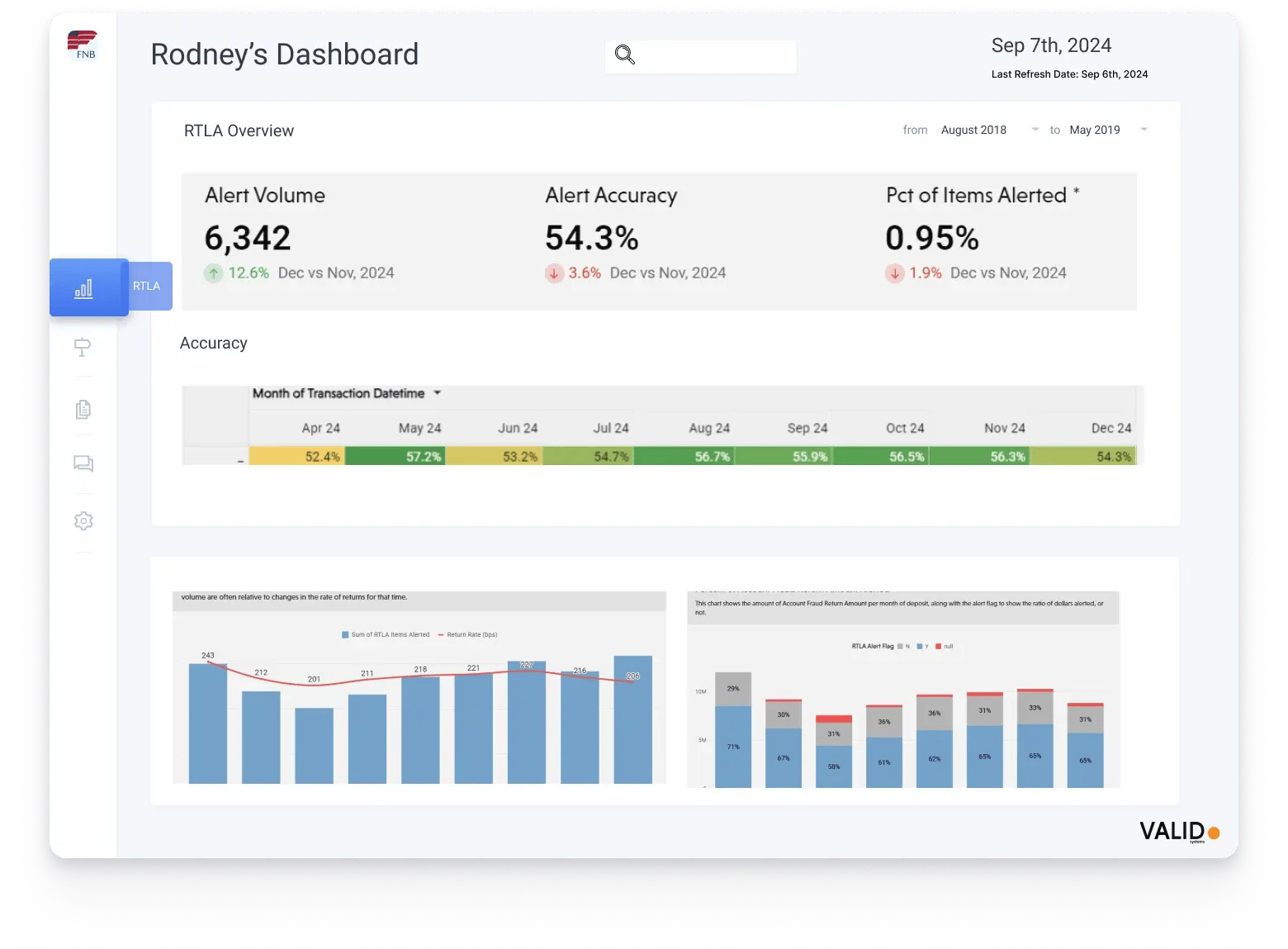

Custom dashboards with actionable intelligence

VALID check fraud detection vs. traditional solutions

See how VALID check fraud detection compares with other traditional solutions.

| Feature | VALID Systems | Legacy Systems |

|---|---|---|

|

Real-time fraud decisioning

|

Yes

|

Delayed or batch-based

|

|

MICR and serial number analysis

|

Advanced cross-checking

|

Basic validation only

|

|

Machine learning + behavioral analytics

|

ML-powered

|

Rule-based only

|

|

Channel-agnostic detection

|

All deposit sources

|

Limited to specific channels

|

|

Check risk triaging

|

Severity scoring enabling differentiated treatment

|

Large manual review queues

|

|

False positive alerts

|

Reduce by 75% or more

|

60%+ with low-accuracy alerting

|

|

Fraud capture rate

|

>95%

|

Unable to capture new fraud trends and tenured account fraud

|

Protect more, review less

VALID’s check fraud detection tools are trusted by the nation's top banks. Whether you want to reduce operational overhead or stay ahead of increasingly sophisticated check fraud tactics, VALID delivers measurable results.

-

Used by top 10 FI's

-

Drive automated holds with 80%+ accuracy on high-risk alerts

-

Absorbs risk on guaranteed deposits

-

Maintains GLBA compliance

-

Guaranteeing $5.8B in check deposits for instant availability monthly

WHAT CUSTOMERS SAY

"Our partners at VALID Systems are always quick to provide us with any information we needed, and their responsiveness and professionalism really help us to be successful. They are flexible and accommodating, never hesitating to provide the support we need, when we need it."

Project Manager

Top 10 FI

"VALID Systems has been an outstanding partner. From inception to post-production, the team was incredibly attentive, accommodating and dependable. The passion for their solutions shines through, making it a pleasure to work with them. With VALID’s help we've been able to expand our services and deliver improved experiences to our clients."

Megan Dunn

KeyBank

"At Deluxe, we believe in transforming business and VALID is a partner that helps us do just that. VALID Systems is at the core of our purpose, deepening customer relationships through trusted technology-enabled solutions. They are a trusted risk partner that enables innovation and continues to deliver."

Sarah Farrow

Deluxe, Digital Payments

Precise check fraud detection, built for the future of banking

Real-time. Behavioral. Bank-verified. Discover the system that top financial institutions already trust.

Frequently Asked Questions

How does VALID detect counterfeit checks?

VALID combines device fingerprinting, account behavioral context, check deposit monitoring, and transaction patterns to detect unusual account activity before a check is even accepted.

Can I set custom fraud thresholds?

Yes, fraud detection rules and severity scoring thresholds can be tailored to your institution’s risk tolerance.

Does VALID integrate with mobile and ATM deposits?

Yes, VALID is fully channel-agnostic and integrates with all deposit sources including ATMs, mobile apps, and teller systems.

What is the false positive rate?

Typically, under 0.5% of deposits are flagged, dramatically reducing unnecessary reviews.

Do you offer guaranteed risk protection?

Yes. ATO protection is embedded within our Real-Time Loss Avoidance engine, delivering holistic, context-aware fraud prevention.