Significant Reduction of Check Fraud Loss using RTLA (Real Time Loss Alerts) at a top 10 National Bank

Industry

Financial Services

Challenge

Client bank experienced rising cases of check fraud and charge off loss in 2022 and decided to adopt RTLA

Results

73% decrease in losses YoY

Key Product

Real Time Loss Alert

"Our partners at Valid Systems were always very quick to provide us with any information we needed to be successful, and their responsiveness and professionalism really helped us to be successful. They were flexible and accommodating, never hesitating about jumping on an off hours call with us, providing us with the support we needed, when we needed it"

Anonymous

Project Manager

Key Takeaways

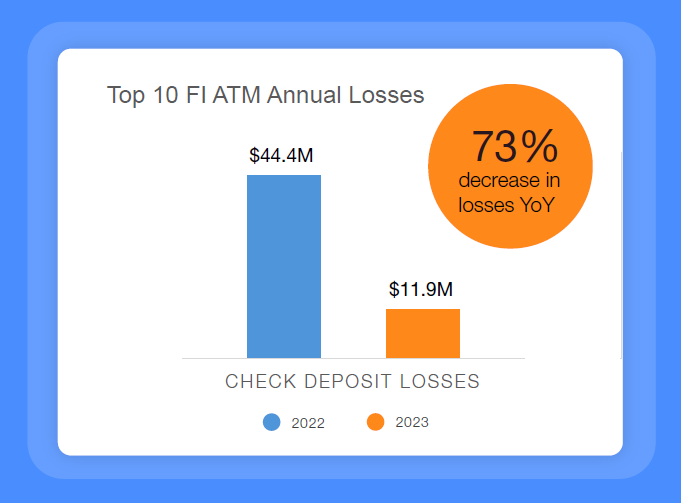

- ATM losses increase drastically for Top 10 FI through ‘22

- Real Time Loss Alerts© by VALID are introduced at the end of Q1 ‘23

- High-accuracy alerts from VALID on check deposits are immediately held by the FI

- RTLA© enabled a 73% decrease in losses as well as reduction of manual review of risky check deposits

The Challenge

Our client, a leading U.S. bank faced a growing wave of check fraud across multiple channels, including in-branch, mobile, and ATM deposits. Fraudsters were exploiting gaps in real-time detection, leading to significant financial losses and customer dissatisfaction. The bank sought a robust, scalable solution to detect and mitigate fraudulent activities without adding friction to legitimate customer transactions.

The Solution

The bank adopted Valid Systems' Real-Time Loss Alerts (RTLA), leveraging its cutting-edge machine learning technology to proactively monitor, detect, and alert fraud risks across all deposit channels. RTLA integrated seamlessly with the bank’s existing fraud management infrastructure, delivering real-time insights and enabling the bank to take immediate action on suspicious activities.

Key features included:

- Dynamic fraud detection ML model to identify patterns indicative of check fraud and charge off loss

- Actionable alerts that prioritized high-risk transactions for manual review.

- Customizable thresholds to balance fraud prevention, operational efficiencies and customer experience

The Results

Within six months of implementation:

- Reduction in check fraud losses by 73%, translating to millions of dollars saved.

- Enhanced detection accuracy, reducing false positives by 40%.

- Improved operational efficiency, with a 25% decrease in manual review time for flagged transactions.

- Positive customer feedback due to the seamless nature of the enhanced fraud prevention measures and false positive reduction.